BanksterCrime:

By Pam Martens and Russ Martens,

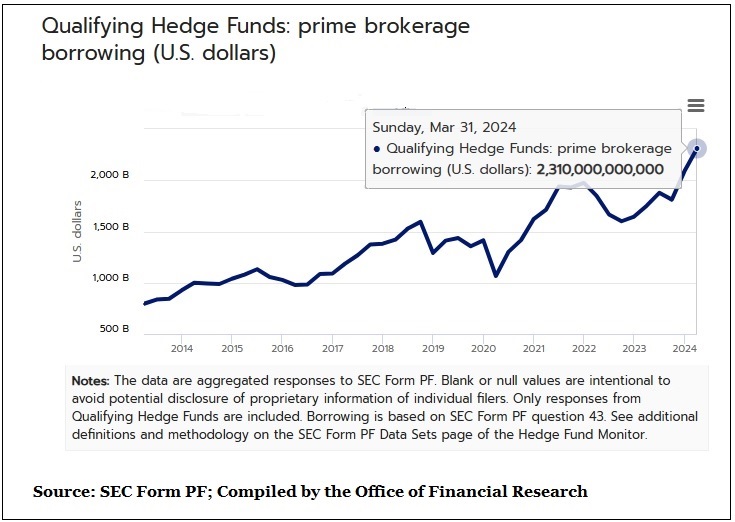

The Office of Financial Research (OFR), the federal agency created after the 2008 financial collapse on Wall Street to defog the lenses of federal regulators to prevent a replay of that disaster, has posted frightening graphs on its website as part of its “Hedge Fund Monitor.”

Particularly alarming is the overall takeaway that the U.S. megabanks that are receiving federal deposit insurance that is backstopped by hardworking and law-abiding U.S. taxpayers, are using their lending ability to make massive loans to dodgy, giant hedge funds that are regularly found to be on the wrong side of the law and/or engaging in wildly risky behavior.

Equally concerning is whether megabank lending to giant hedge funds is sapping their ability to make loans to worthy U.S. businesses that are engaged in the real economy rather than the financial casino economy of hedge funds.

Take the chart at the top of the page as one example. It shows that just three megabanks provided a combined $1.832 trillion in credit to “Qualifying Hedge Funds” as of March 31, 2024. This represented 79 percent of all such loans, which had a total value of $2.31 trillion. (See chart at the bottom of the page.) “Qualifying Hedge Fund” is defined as follows:

“A Qualifying Hedge Fund is any hedge fund with net assets of at least $500 million that is advised by a Large Hedge Fund Adviser. Net assets are measured individually or in combination with any feeder funds, parallel funds, or dependent parallel managed accounts. Large Hedge Fund Advisers, according to SEC Form PF, have at least $1.5 billion in hedge fund assets under management across one or more funds.”

Megabanks always find some benign-sounding name for their most dangerous operations. In the case of their massive lending and red-carpet services to giant hedge funds, they call it “Prime Broker” operations.

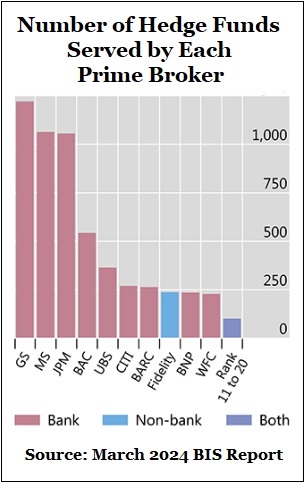

The Office of Financial Research has not included the names of the three megabanks that have taken on this enormous, $1.8 trillion concentrated risk with hedge funds, but the chart to the right might offer a big clue as to those names. According to this March 4 report from the Bank for International Settlements, the Prime Broker operations of Goldman Sachs (GS), Morgan Stanley (MS), and JPMorgan Chase (JPM) (all U.S. financial institutions which own federally-insured banks) were each servicing more than 1,000 hedge funds as of 2022.

The fact that the Office of Financial Research is simply “monitoring” this potentially explosive situation while the federal banking regulators for whom it conducts its research allow this dangerous and incestuous situation to grow, is simply more evidence of completely captured regulators.

It’s not like federal regulators don’t have sufficient evidence that hedge funds and deposit-taking banks create a dangerous, combustible mix.

In the spring of 2021, Credit Suisse lost $5.5 billion from the highly-leveraged, highly concentrated stock positions it was financing via ginned-up derivatives for the family office hedge fund, Archegos Capital Management. Archegos blew up on March 25, 2021 after it defaulted on margin calls to the banks financing its trades. An internal report for the Board of Directors of Credit Suisse by the outside law firm Paul, Weiss, Rifkind, Wharton & Garrison found that Credit Suisse “was focused on maximizing short-term profits and failed to rein in and, indeed, enabled Archegos’s voracious risk-taking.” Credit Suisse exists no more. Its demise was hastened by its involvement with the Archegos hedge fund. Credit Suisse was sold in a shotgun wedding and fire sale to its long-time rival, UBS, in March 2023.

And, of course, the largest hedge fund blowup of all time was that of Long-Term Capital Management (LTCM) in 1998. The Chair of the Commodity Futures Trading Commission at the time, Brooksley Born, described the event as follows for PBS:

“I got a call from the Treasury Department, probably the weekend that it nearly collapsed. This was in actually September ’98. And I was told that the very large hedge fund was almost collapsing, that it had $1.25 trillion in notional value of over-the-counter (OTC) derivatives, and it only had $4 billion in capital to support that enormous investment, and that the markets had turned against it…so that it was going to default in a very major way….”

LTCM created a major market panic, leading to the New York Fed forcing the banks that were LTCM’s major counterparties to inject approximately $3.6 billion in capital to allow for a gradual unwinding of the hedge fund.

Between September 1, 1998 and October 8, 1998 – as the Long-Term Capital Management crisis played out, the stock of JPMorgan Chase lost 35 percent of its market value. Other megabanks also took large hits to their share prices, further fueling market panic and instability.

Apparently, federal banking regulators have become incapable of learning from the lessons of the past.

![]()