Wall Street Outraged Over Latest Epic F*ck Up By Biden’s Labor Department

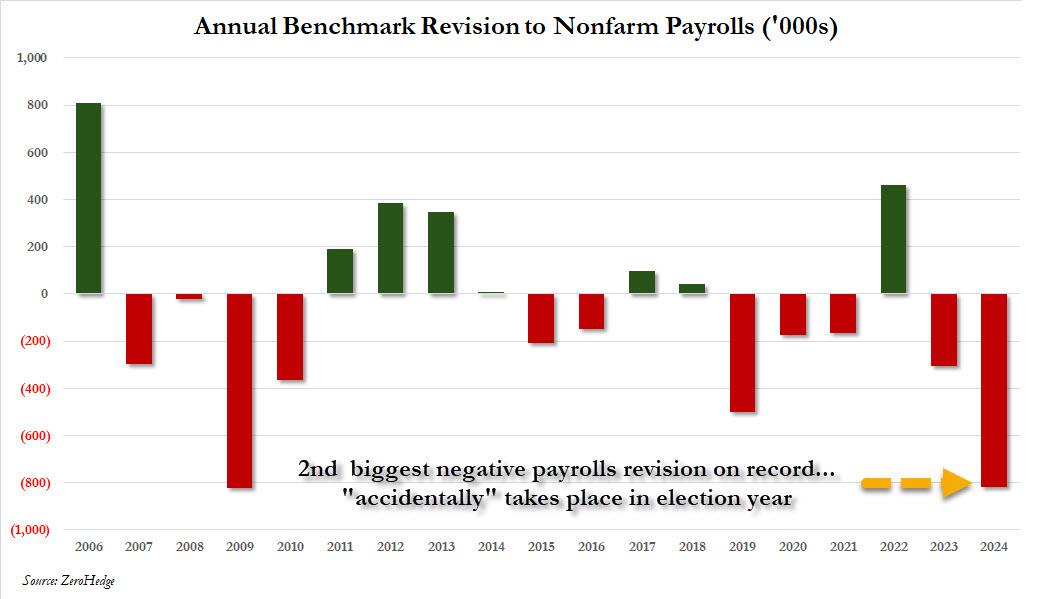

By SRH, It’s strikingly ironic that on the very day the financial community was poised for the Biden administration’s notoriously politicized and woefully inept Bureau of Labor Statistics to acknowledge its significant miscalculation of job data from the past year, the Bureau managed to outdo itself in incompetence. The BLS was scheduled to unveil its annual CES Preliminary Benchmark Announcement revision at 10 a.m. ET today, providing an update on the number of jobs that were, for lack of a better term, fabricated over the previous year (as we noted earlier, the figure stood at 818,000, marking the second-largest annual overestimation of job creation in U.S. history—an occurrence that seems purely coincidental in an election year).

However, at 10:01 a.m. ET, the anticipated announcement failed to materialize: millions of traders, thousands of economists, and a multitude of market watchers were frantically refreshing the revisions page, only to find… no updates. This cycle of anticipation dragged on, and while the market reacted as if data had been released, it turned out that algorithms were merely responding to non-existent triggers in a bid to create upward or downward momentum. No actual data was disclosed.

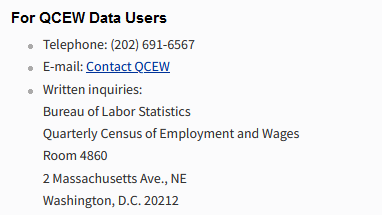

As it turns out, at least some people had more luck than us in reaching said department (we repeatedly got voicemail with the promise that someone would get back to us in 24-48 hours), because as Bloomberg reports, “at least three banks managed to obtain key payroll numbers Wednesday while the rest of Wall Street was kept waiting for a half-hour by a government delay that whipsawed markets and sowed confusion on trading desks.”

That’s right: while the rest of the world was freaking out, paralyzed by the gross incompetence of the Biden Department of Labor (which, as a reminder, was merely informing us of just how incompetent it truly was by overestimating nearly 1 million jobs in 2024), banks such as Mizuho, BNP Paribas and Nomura all called into the phone number listed above… and got the answer, by some absolute BLS moron who was not aware that they are leaking material, non-public information to extremely sophisticated investors while the rest of the world was stuck in the dark courtesy of, well, other absolute BLS moron who had days if not weeks to prepare today’s report and yet still couldn’t get it out on time… or even 30 minutes after time.

And then, frustration turned to anger and outrage on Wall Street as word spread from trading desk to trading desk that the BLS was releasing the number to some firms over the phone!

When the data was finally released shortly after 10:30 am, it showed payrolls will likely be revised down by 818,000 for the 12 months through March, the biggest downward revision to the job numbers since 2009.

Stocks initially jumped and bonds gained because the report lent support to speculation that the Fed will start cutting interest rates next month, then quickly reversed as panic seemed to sweep over Wall Street at the thought that the BIden admin had been actively covering up a labor market recession. In the end, hopium won out and stocks closed near the highs of the day, because – well – Powell will always make sure stocks keeps rising.

“I don’t wonder that people are upset,” Nancy Tengler, the chief executive officer of Laffer Tengler Investments. “The whole thing reeks of incompetence.”

Well, yeah, but what makes it especially hilarious is that the incompetence came on the day the BLS was admitting 12 months of prior propaganda incompetence. Seriously, not even the USSR had fuck ups of this caliber.

The delay – and subsequent one-by-one disclosure – is the latest in a series of embarrassing mishaps to roil Labor Department data releases, which hilarious is who the markets have to rely on for “accurate” data on the state of the US labor market and the trajectory of inflation and the economy.

In a post on X, the agency said it was “looking into the reason for the delay”…

… to which we responded that when the idiots responsible for this latest fuck up are fired, the BLS should make sure to seasonally adjust it so it adds at least another 1 million government jobs.

As Bloomberg reminds us, the government’s economic data reports were once released under tightly controlled embargos to accredited news agencies, including Bloomberg. But the practice was abandoned during the pandemic, when departments across the government shifted to just releasing the data on the Internet to everyone at once. Officials said that method would better protect the security of market-moving data, but instead all it did was create groups of wealthy “super users” who had preferential and early access to government data from Biden’s corrupt agency.

When it didn’t come out on time, Yelena Shulyatyeva, senior US economist BNP Paribas, said she kept refreshing the web page, waiting for the numbers. Then “we called the public line a couple times and they gave us the number,” she said.

Steven Ricchiuto, chief US economist at Mizuho, did the same. “Knowing the data was delayed we had to call for the number before it showed up on their website,” he said.

ZeroHedge itself received the leaked data at 10:24am ET through our expert network, but not even we dared to publish it to our premium subscribers amid concerns that the BLS could not possibly be this stupid and incompetent to be releasing the number on a case by case basis instead of blasting it to the entire world at the same time.

In the end, it turned out the BLS was even more incompetent than we could possibly imagine.

“I am more than a little annoyed,” said Troy Ludtka, senior US economist at SMBC Nikko Securities Americas, who was among those who waited on the public release.

“To put it in the most generous terms: Government agencies absolutely cannot be selectively releasing critical, market-moving information to some agents and broker dealers first via telephone while keeping others in the dark,” he said. “This is anathema to the very idea of a balanced market built on fair, accessible information.”

Troy, but you ain’t seen nothing yet: if Kamala wins and if the US goes full Kam-unist, the very idea of a balanced market will be anathema, replaced by centrally planned… well, everything. Source

![]()