BanksterCrime:

By Pam Martens and Russ Martens,

Exactly how long is it going to take federal banking regulators to figure out that “move fast and break things” – the business model of Silicon Valley financial technology (fintech) startups and their voracious venture capital backers – is the last thing that Americans want to be integrated into the FDIC-insured bank where they hold their money to pay their mortgage and to buy food to feed their children.

After one form of fintech – crypto – hastened the demise of several FDIC-insured banks in the spring of last year, handing billions of dollars in losses to the FDIC’s Deposit Insurance Fund, a rational person might have thought that federal banking regulators would have moved rapidly to shut down this lunatic banking model. But no. The story becomes ever more surreal today.

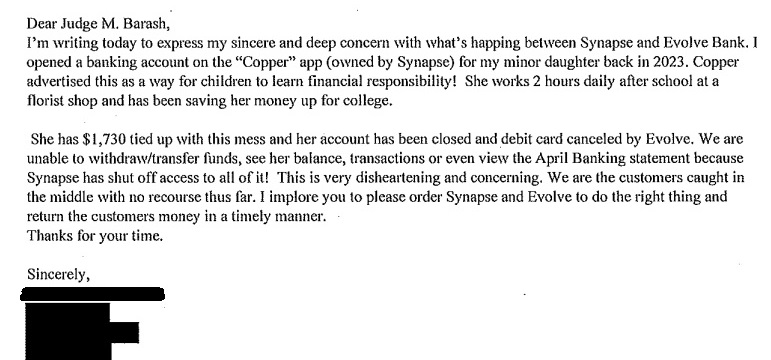

Below is the desperate plea filed on Tuesday with the court that is hearing the bankruptcy proceedings of the fintech firm, Synapse Financial Technologies. A father says his daughter has been working after school at a florist shop to save money for college and now finds that her $1,730 in deposits, ostensibly placed at FDIC-insured Evolve Bank and Trust by Synapse, have disappeared into a black hole.

Customers of another fintech, Yotta, are screaming on Reddit that they also can’t get access to what they were told by Yotta would be FDIC-insured deposits held at Evolve Bank and Trust. The Synapse bankruptcy appears to also be at the center of the Yotta/Evolve Bank and Trust mess.

Yotta explains itself like this on its website: “Instead of a simple flat interest rate that other bank accounts have, Yotta offers a prize-linked account that pays interest in prizes.” (What could possibly go wrong with this model?) The text on the rest of that Yotta website page is so bizarre that it feels like satire on Saturday Night Live.

Synapse is a fintech startup that had financial backing from Andreessen Horowitz, the giant Menlo Park, California venture capital firm. Synapse describes itself as “a finance platform” that “provides payment, card issuance, deposit, lending, compliance, credit and investment products as APIs [Application Programming Interface] to more than 18 million end users.”

Apparently, other FDIC-insured banks besides Evolve Bank and Trust are also involved in this mess. In 2023 Synapse announced “A New Partnership with AMG National Trust.” In 2022, it announced a “Partnership with Lineage Bank.” Synapse’s partnership with Evolve Bank and Trust dates back to 2017 and was renewed in 2022.

If all of this isn’t frightening enough, Synapse shares on its website that it also owns a registered broker-dealer (brokerage firm) that is regulated by Wall Street’s self-regulator, FINRA.

According to documents filed in the bankruptcy court proceedings, on May 11 of this year Synapse discontinued access to its dashboard that allowed bank visibility to critical financial data, such as beneficial owner account balances.

On May 17, Evolve Bank and Trust posted this statement on its website:

“Evolve Bank & Trust supports today’s (Friday, May 17, 2024) United States Bankruptcy court rulings regarding our motion and maintains unwavering dedication to safeguarding the security of all end user funds. Since the unfortunate necessity of freezing certain transactions, our teams have been tirelessly working to guarantee account accuracy, enhancing security measures, and ultimately restoring access to funds for our valued customers.

“Today’s rulings and Judge Martin R. Barash’s remarks serve to validate what we have steadfastly asserted all along: Synapse’s abrupt shutdown of essential systems without notice and failure to provide necessary records needlessly jeopardized end users by hindering our ability to verify transactions, confirm end user balances, and comply with applicable law. Evolve’s position is further corroborated by the U.S. Trustee’s emergency filing, which warns of Synapse’s ‘gross mismanagement’ in deciding to cut off access to its computer systems over a weekend.

“As a robustly well-capitalized FDIC institution exceeding the capital thresholds for the highest category of capitalization under PCA (‘well capitalized’), our primary focus is on ensuring the protection of end user funds. This becomes paramount when essential reporting and information necessary for transaction processing are not forthcoming from our critical service provider.

“Evolve operates in accordance with federal regulations governing financial institutions. Any insinuation suggesting that Evolve has intentionally mishandled or withheld funds is entirely false and defamatory.

“As we move forward, Evolve Bank & Trust reaffirms our commitment to collaborating with financial industry partners with the shared goal of providing customers access to their funds. We are dedicated to addressing any challenges that arise with agility and efficacy, ensuring the integrity and security of all customer funds remain paramount.”

Anyone who thinks this is going to end well might want to browse the following:

Related Articles:

As far back as August of 2022 we warned: Brace Yourself for Federally-Insured Bank Failures Caused by Crypto

Beef in Bulk: Half, Quarter, or Eighth Cow Shipped to Your Door Anywhere within Texas Only

We do not mRNA vaccinate our cattle, nor will we ever!

Grass Fed, Grass Finished Beef!

From Our Ranch to Your Table

![]()