BanksterCrime:

Delinquencies on Office Property Loans at Banks Are at 8 Percent While Office Loans the Banks Sold to Investors Show 31 Percent in Trouble

By Pam Martens and Russ Martens,

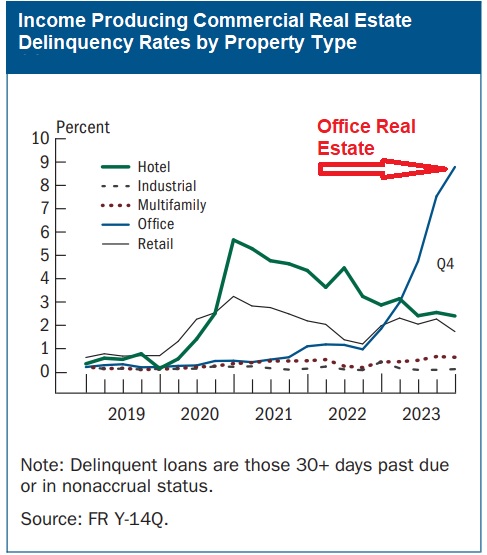

On Friday, the Federal Reserve released its semiannual Supervision and Regulation Report on banks. Commercial real estate loans at banks – particularly on office properties – continued to rank high on the Fed’s list of concerns. The Fed included the chart above showing that delinquency rates on office property loans held by the banks had skyrocketed from just over 1 percent at the end of 2022 to over 8 percent as of December 31, 2023. (The red text and arrow have been added by Wall Street On Parade.)

Banks are major lenders to the commercial real estate (CRE) market, providing almost $3 trillion in financing. According to a February 27 report from S&P Global, as of the end of the fourth quarter of 2023, two megabanks dwarfed all others in their commercial real estate loan exposure. JPMorgan Chase Bank NA, the largest bank in the U.S., held $173.31 billion in CRE loans while Wells Fargo Bank NA held $139.65 billion. Bank of America ranks second to JPMorgan Chase Bank NA in terms of assets, and yet its CRE loan exposure is less than half that of JPMorgan Chase, at $82.80 billion, according to S&P Global.

Friday’s Fed report built on concerns expressed by the Fed in its April release of its Financial Stability Report. The Fed voiced the following concerns in the April report in regard to the commercial real estate market:

“CRE market conditions continued to deteriorate, especially for the office sector, and prices continued to decline against a backdrop of high vacancy rates and weakening rents…

“The CRE office sector has faced strains resulting from an ongoing post-pandemic adjustment, and these strains could contribute to additional weakness in prices and rents going forward. Vacancy rates for offices located in central business districts and coastal cities increased further, and rents continued to decline since the October report.”

The Fed also noted that in its March 2024 Senior Credit Officer Opinion Survey, it had added a “special question” related to Commercial Mortgage-Backed Securities (CMBS) that were collateralized with office properties. It said that the answers from senior credit officers pointed to “a tightening of financing terms and weakening of liquidity in the office CMBS market, as collateral quality has weakened and demand for funding has increased.”

Just how much pain is being felt in the CMBS market related to office properties was further quantified on May 3 when Scott Carpenter reported the following at Bloomberg Law:

“About $52 billion, or 31%, of all office loans in commercial mortgage bonds were in trouble in March, according to KBRA Analytics.

“That share is up from 16% a year ago, according to the firm. Some cities have bigger headaches than others, with Chicago and Denver offices having 75% and 65% in jeopardy, respectively.”

Pause for a moment and let those surreal numbers sink in. According to the New Capital Journal, Chicago ranks third among U.S. cities for GDP output, after New York City and Los Angeles. But 75 percent of the office property loans bundled into CMBS and sold to investors are in trouble?

The fact that the Fed is reporting that a little more than 8 percent of the office loans still on the books of the banks are in trouble but somehow 31 percent of the office loans the banks bundled into CMBS and sold to investors are in trouble hints at a replay of the tricked-up operations of the megabanks heading into the 2008 financial collapse. Some banks back then told their sales staff to make it a top priority to bundle and sell their “shitty deals” to investors and then made billions by shorting (betting against) the toxic waste they knew were in those deals.

On April 13, 2011, following a two-year investigation, Senators Carl Levin and Tom Coburn, Chairman and Ranking Member of the Senate’s Permanent Subcommittee on Investigations, released a 635-page report on the 2008 financial crisis, which detailed the fraudulent role that Wall Street megabanks had played in crashing the U.S. economy. The report includes this paragraph on how Goldman Sachs attempted to profit from its own “shitty deals”:

“When Goldman Sachs realized the mortgage market was in decline, it took actions to profit from that decline at the expense of its clients. New documents detail how, in 2007, Goldman’s Structured Products Group twice amassed and profited from large net short positions in mortgage related securities. At the same time the firm was betting against the mortgage market as a whole, Goldman assembled and aggressively marketed to its clients poor quality CDOs [Collateralized Debt Obligations] that it actively bet against by taking large short positions in those transactions. New documents and information detail how Goldman recommended four CDOs, Hudson, Anderson, Timberwolf, and Abacus, to its clients without fully disclosing key information about those products, Goldman’s own market views, or its adverse economic interests. For example, in Hudson, Goldman told investors that its interests were ‘aligned’ with theirs when, in fact, Goldman held 100% of the short side of the CDO and had adverse interests to the investors, and described Hudson’s assets were ‘sourced from the Street,’ when in fact, Goldman had selected and priced the assets without any third party involvement. New documents also reveal that, at one point in May 2007, Goldman Sachs unsuccessfully tried to execute a ‘short squeeze’ in the mortgage market so that Goldman could scoop up short positions at artificially depressed prices and profit as the mortgage market declined.”

See the video clip below from a related hearing, featuring the late Senator Carl Levin questioning a Goldman Sachs executive, Daniel Sparks, on how it pushed its “shitty deal” onto unsuspecting investors.

Related Articles:

Slim sized Perfume Oils are perfect to take with you in your hand bag, gym bag, or for traveling. Roll a small amount on your pulse points. These are very concentrated, absorb quickly, and last a long time.

Our fragrances do not have Phthalates, alcohol, parabens, or dyes!

Warm Sandalwood is a warm, rich, and woodsy scent. The colors are warm and rich with brown, gold, and white.

Each Perfume Oil bottle will contain approximately 0.3 ounces and be approximately 3.25 inches tall.

Allergen: Our products contain oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get in your eyes. GoShopping

![]()