BanksterCrime:

Wall Street’s Judge Shopping Continues: It’s Trying to Stop the FTC’s Ban on Worker Handcuffs Known as Non-Compete Agreements

By Pam Martens and Russ Martens,

Sullivan & Cromwell, the go-to law firm for Wall Street in the past, has become a case study in how not to manage one’s corporate reputation. (See Wall Street’s Go-To Law Firm, Sullivan & Cromwell, Got in Bed with Crypto; Now Its Reputation Is Being Hammered.)

Apparently, having previously represented FTX fraudster, Sam Bankman-Fried, and then grabbing FTX’s bankruptcy proceeding and billing $180 million, is not enough shame for Sullivan & Cromwell to heap on its reputation. It is now listed as the Big Law firm that filed a federal lawsuit yesterday on behalf of the corporate front groups, the U.S. Chamber of Commerce, the Business Roundtable, and others, to stop the Federal Trade Commission’s (FTC’s) new rule banning non-compete agreements for most workers. (An 8-attorney law firm in Texas, Potter Minton, is also listed on the filing for the plaintiffs.)

Sullivan & Cromwell’s filing of the lawsuit came just one day after the FTC announced its final rule banning the non-compete agreements, which suppress workers’ ability to advance their careers and advocate for higher wages. The ruling follows an anti-trust focused Executive Order signed by President Joe Biden in 2021 that asked the FTC to ban or restrict clauses in employment agreements that hinder workers’ freedom to change jobs.

Sullivan & Cromwell is headquartered in New York. The U.S. Chamber of Commerce is headquartered in Washington, D.C. as is the Federal Trade Commission. But the lawsuit against the FTC was filed in a U.S. District Court in Tyler, Texas.

The watchdog, Accountable.US, has released a statement assigning nefarious motives to the court venue selected by the plaintiffs. It wrote:

“Predictably, the U.S. Chamber has once again filed their lawsuit in Texas federal court to ensure it falls under the jurisdiction of the conservative Fifth Circuit Court of Appeals despite facing increased scrutiny for venue and judge shopping with lawsuits aiming to block pro-consumer and worker regulations to protect record corporate profits.”

Accountable.US released a study showing court cases filed in courts within the Fifth Circuit where corporate interests attempted to trample on worker or consumer rights by overturning federal agency issued rules. It noted that just last month the U.S. Chamber of Commerce had filed a lawsuit in another U.S. District Court within the Fifth Circuit that challenged the Consumer Financial Protection Agency’s (CFPB’s) recent ruling that capped credit card late fees at $8, which could save consumers approximately $10 billion a year in late fees. (Wall Street’s megabanks that issue their own credit cards are a major beneficiary of extracting billions of dollars in late fees from their credit card customers.)

Another case brought in 2017 by the U.S. Chamber in a Fifth Circuit court went to the heart of preserving Wall Street’s private justice system which forces customers to sign away their rights to file claims against Wall Street firms before a jury of their peers in a public courtroom. Customers must contractually agree instead to have their cases heard by one of the deeply conflicted arbitration groups that get lucrative repeat business from Wall Street. Accountable.US writes:

“In September 2017, the U.S. Chamber joined banking groups in a lawsuit filed in the Northern District of Texas aimed at blocking CFPB rulemaking banning forced arbitration clauses in financial services contracts, contesting it used ‘biased data.’ The Chamber later received a major victory when the Senate voted to overturn the law, subsequently dropping the case when former President Trump signed the law into action in November 2017.”

The vote to overturn the consumer-friendly CFPB ruling on mandatory arbitration was so controversial that Republican Senators Lindsey Graham and John Kennedy voted against it, abandoning their other gung-ho Republican colleagues. Senate Democrats voted to preserve the rule, which forced the Republicans to summon Vice President Mike Pence to cast the deciding vote to pass the repeal. President Trump signed the anti-consumer legislation into law. For our deep-dive reporting at the time, see Mike Pence Secures the No Law Zone Around Wall Street.

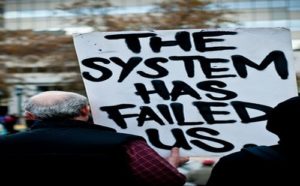

Between Wall Street’s kangaroo-court private justice system, its non-compete agreements, its non-disclosure agreements, its non-disparagement agreements, and its insidious TROs (Temporary Restraining Orders), it’s no wonder Wall Street has also become a major crime center in America.

Slim sized Perfume Oils are perfect to take with you in your hand bag, gym bag, or for traveling. Roll a small amount on your pulse points. These are very concentrated, absorb quickly, and last a long time.

Our fragrances do not have Phthalates, alcohol, parabens, or dyes!

Warm Sandalwood is a warm, rich, and woodsy scent. The colors are warm and rich with brown, gold, and white.

Each Perfume Oil bottle will contain approximately 0.3 ounces and be approximately 3.25 inches tall.

Allergen: Our products contain oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get in your eyes. GoShopping

![]()