Paul’s charge to us in Romans 13:8 to owe nothing but love is a powerful reminder of God’s distaste for all forms of debt that are not being paid in a timely manner (see also Psalm 37:21). At the same time, the Bible does not explicitly command against all forms of debt. The Bible warns against debt, and extols the virtue of not going into debt, but does not forbid debt. The Bible has harsh words of condemnation for lenders who abuse those who are bound to them in debt, but it does not condemn the debtor.

Some people question the charging of any interest on loans, but several times in the Bible we see that a fair interest rate is expected to be received on borrowed money (Proverbs 28:8; Matthew 25:27). In ancient Israel, the Law did prohibit charging interest on one category of loans—those made to the poor (Leviticus 25:35-38). This law had many social, financial, and spiritual implications, but two are especially worth mentioning. First, the law genuinely helped the poor by not making their situation worse. It was bad enough to have fallen into poverty, and it could be humiliating to have to seek assistance. But if, in addition to repaying the loan, a poor person had to make crushing interest payments, the obligation would be more hurtful than helpful.

Second, the law taught an important spiritual lesson. For a lender to forego interest on a loan to a poor person would be an act of mercy. He would be losing the use of that money while it was loaned out. Yet that would be a tangible way of expressing gratitude to God for His mercy in not charging His people “interest” for the grace He has extended to them. Just as God had mercifully brought the Israelites out of Egypt when they were nothing but penniless slaves and had given them a land of their own (Leviticus 25:38), so He expected them to express similar kindness to their own poor citizens.

DEFINITION of Bad Bank

A bad bank is one, set up to buy the bad loans of another bank with significant nonperforming assets at market price. By transferring such assets to the bad bank, the original institution may clear its balance sheet (although it will still be forced to take write-downs).

A bad bank corporate structure may also assume the risky assets of a group of financial institutions, instead of a single one.

BREAKING DOWN Bad Bank

While shareholders and bondholders generally stand to lose money from this solution, depositors usually do not. Banks that become insolvent as a result of the process can be recapitalized, nationalized or liquidated. If they do not become insolvent it is possible for a bad bank’s managers to focus exclusively on maximizing the value of its newly acquired high-risk assets.

Some criticize the setup of bad banks, highlighting how, if states take over non-performing loans, this encourages banks to take undue risks, leading to a moral hazard.

McKinsey outlined four basic models for bad banks in 2009. These included:

- An on-balance-sheet guarantee (often a government guarantee), which the bank uses to protect part of its portfolio against losses

- A special-purpose entity (SPE), wherein the bank transfers its bad assets to another organization (again, typically backed by the government)

- A more transparent internal restructuring, in which the bank creates a separate unit to hold the bad assets (a solution not able to fully isolate the bank from risk)

- A bad bank spinoff, wherein the bank creates a new, independent bank to hold the bad assets, fully isolating the original entity from the specific risk

Examples of Bad Bank Structures in Recent History

A well-known example of a bad bank was Grant Street National Bank. This institution was created in 1988 in order to house the bad assets of Mellon Bank. The financial crisis of 2008 revived interest in the bad bank solution, as managers at some of the world’s largest institutions contemplated segregating their nonperforming assets.

Federal Reserve Bank Chairman Ben Bernanke proposed the idea of using a government-run bad bank in the recession, following the subprime mortgage meltdown. The purpose of this would be to clean up private banks with high levels of problematic assets and allow them to begin lending once more. An alternate strategy, which the Fed considered, was a guaranteed insurance plan. This would keep the toxic assets on the banks’ books but eliminate the banks’ risk, instead of passing it on to taxpayers.

Outside of the U.S. in 2009 the Republic of Ireland formed a bad bank, the National Asset Management Agency in response to the nation’s own financial crisis. Source

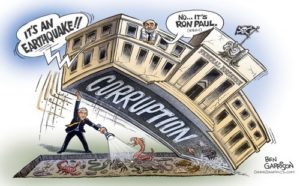

Corrupt bank scandals are magnified by each other, loan to own schemes which destroy the small businessman on a regular basis, Goldman Sachs bankers seem to have a corner on the market along with Bank of America just to mention a few bad corrupt banks. They’re part of a pattern, lawlessness, greed, self-centered ambition, one that the American public is hyper-aware of. These headlines foment distrust in the fairness of the entire system, Bank is corrupt by design….

Bankers and gangsters are mainstream in today’s financial institutions, these large to midsize banks and there under links the “bankers” are the corrupt wheeler-dealers, they manipulated markets, sliced and diced mortgages (fraudulent foreclosures) and played loose with other people’s money, they are gangsters.. Their history proves the bad fruit that has harmed the American people….

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

![]()