By Pam Martens and Russ Martens:

Yesterday, American Banker released a report showing that five banks in the U.S. hold a combined half trillion dollars in commercial real estate (CRE) loans. It came as a big surprise to a lot of folks that the bank holding the largest amount of CRE loans is JPMorgan Chase – whose bank holding company is also exposed to $49 trillion in derivatives as of December 31, 2023 according to the Office of the Comptroller of the Currency. (See Table 14 at this link.)

JPMorgan Chase is already considered the riskiest bank in the U.S. according to its regulators.

American Banker reported the following CRE totals for the five banks: JPMorgan Chase, $173 billion; Wells Fargo, $139.65 billion; Bank of America, $82.8 billion; U.S. Bank, $55.66 billion; and PNC Bank, $48.89 billion.

Some of the same hubris and willful blindness that prevailed in the runup to the subprime mortgage crisis that blew up large financial institutions in 2008 is showing itself today in regard to commercial real estate loans at federally-insured banks.

On March 7, Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee as part of his Semiannual Monetary Policy Report to Congress. During his testimony, Powell downplayed concerns about the impact of commercial real estate loans at the largest banks. Powell stated: “There will be bank failures, but this is not the big banks. If you look at the very big banks, this is not a first order issue for any of the very large banks. It’s more smaller and medium size banks that have these issues.”

If CRE is not a problem at the largest banks, that’s because both the banks and the Fed believe that the Fed will always spring to the rescue with an emergency bailout program. In fact, the Fed has already created just such a program that’s waiting in the wings. It’s called the Standing Repo Facility (SRF). It has a lending capacity of $500 billion and can lend to both the federally-insured bank and its trading unit (primary dealer) – thus giving the so-called “universal banks” on Wall Street two bites at the bailout apple.

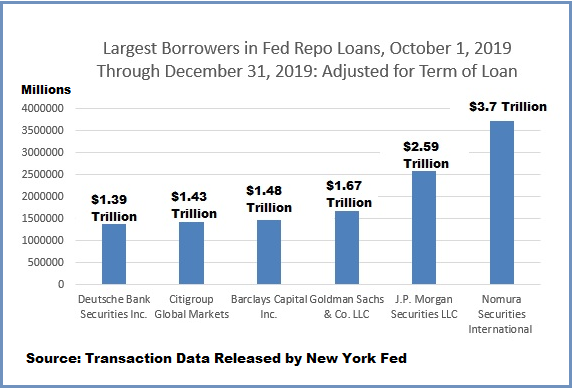

For a look at just how quickly the Fed can sluice money to Wall Street mega banks with few questions asked by Congress, check out the chart below. It shows the Fed’s emergency money spigot to the mega banks in the last quarter of 2019 – for a financial emergency at the banks which has yet to be explained to the American people.

To grasp how radically things have changed since 2008 when former Goldman Sachs veteran-turned Treasury Secretary Hank Paulson took a 3-page document to Congress and demanded a $700 billion taxpayer bailout for the banks (Troubled Asset Relief Program, TARP), let the full meaning of the chart above sink in. The Fed can now funnel trillions of dollars in cumulative loans to mega banks on Wall Street, report the names of the banks and amounts borrowed two years later, and get a complete news blackout from mainstream media. (Wall Street On Parade was the only media outlet to chart the details and report the names of the banks that got the trillions of dollars in loans in 2019.)

Powell might have his own agenda in playing down the risks to the mega banks on Wall Street. According to Senator Elizabeth Warren, who sits on the Senate Banking Committee, Powell is leading the charge behind the scenes to overturn federal regulators’ proposal to require the largest banks to hold larger amounts of capital to prevent a replay of the 2008 financial crisis.

These bars are formulated for special skin needs. Our soaps are gentle and produce a smooth creamy lather that is nourishing to your skin. They leave your skin feeling amazing. Our bars are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents.

Our soaps are made with skin loving ingredients including olive oil, coconut oil, lard, sweet almond oil, shea butter, and castor oil. We do not use palm oil. They are only scented lightly with essential or fragrance oils.

Soaps:

Charcoal Detox Bar is made with Activated Charcoal and an essential oil blend of Tea Tree and Rosemary. All of these ingredients are know for their detoxification properties.

Lavender For Dry Skin is formulated with lots of extra moisturizers for those with dry skin. It is lightly scented with Lavender and Champagne fragrance oil.

Lavender For Oily Skin is specially designed for those with oily skin who want much less moisturizer from their soap bar. It is lightly scented with Lavender Essential Oil.

Pink Salt Bar has a smooth feel on your skin. It is made with pink sea salt and is great for all types of troubled skin. It is lightly scented with our original Honey Almond scent.

Pure Olive Castile contains only olive oil. It is made especially for those with sensitive skin. This is a simple bar with no additives and no scent added, just the natural scent of the olive oil.

Samples give you a chance to try before you buy. You will receive two random samples, unless you specify which ones you would prefer. Each sample will weigh approximately 0.3 ounces.

This listing is for 1 of our beautiful bars of soap. A bar will weigh approximately 4.5 ounces and be approximately 2.25 inches wide by 3.5 inches tall and 1.25 inch thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured.

Please keep your handmade soap well-drained and allow to dry between uses. This will ensure a longer lasting bar.

Allergen: Our soaps contain dairy and oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get soap in your eyes as it will sting slightly. GoShopping

![]()