BanksterCrime:

By Pam Martens and Russ Martens:

On Tuesday, the Vice Chair for Supervision at the Federal Reserve, Michael Barr, delivered a speech at a risk management conference in Manhattan. Barr’s objective was to convince conference attendees that the Fed has its eye on the ball when it comes to Wall Street mega banks and their counterparties who are sitting on the opposite sides of derivative trades totaling tens of trillions of dollars. (Yes, trillions.)

The most illuminating and dangerous elements of Barr’s speech are what he didn’t say.

To remind attendees of what could happen if counterparty risks were not managed properly, Barr cited Long Term Capital Management (LTCM) and Archegos Capital Management.

LTCM was a hedge fund stocked with the so-called “smartest men in the room,” including two Nobel laureates, who fed mathematical formulas into computers that generated trades using astronomical levels of leverage. Of course, this resulted in the brainiacs blowing up the firm in the fall of 1998 during the Russian debt crisis, putting their counterparties – the big trading houses on Wall Street – at grave risk. The New York Fed had to corral the big boys on Wall Street into its conference room and hammer out a multi-bank bailout of the teetering hedge fund.

What happened at Archegos can best be summed up with our headline of 2021: Archegos: Wall Street Was Effectively Giving 85 Percent Margin Loans on Concentrated Stock Positions – Thwarting the Fed’s Reg T and Its Own Margin Rules.

LTCM occurred in 1998, before Sandy Weill, the Bill Clinton administration, Robert Rubin, the New York Times and the Federal Reserve had ushered in the most dangerous banking era in U.S. history by repealing the Glass-Steagall Act and allowing the trading casinos on Wall Street to merge with giant, federally-insured, deposit-taking banks. This explosive situation continues to this day, as do the never-ending Fed bailouts.

The biggest explosions in U.S. banking history from derivatives and insolvent counterparties were, of course, neither LTCM or Archegos. They were Lehman Brothers and AIG – both of which owned federally-insured banks at the time of their demise in 2008, thanks to the repeal of the Glass-Steagall Act in 1999. Lehman Brothers filed for bankruptcy on September 15, 2008. The U.S. government seized control of AIG the following day and “made over $182 billion available to assist AIG between September 2008 and April 2009” according to a report by the Government Accountability Office (GAO). $90 billion of the $182 billion went in the front door of AIG and out the back door to pay 100 cents on the dollar on credit derivative trades that had been made between a dodgy unit of AIG and the major trading houses on Wall Street.

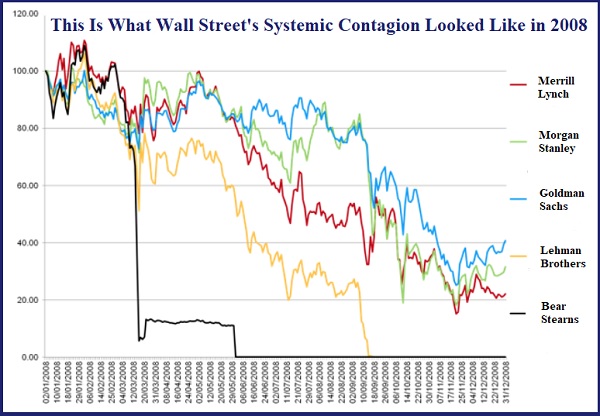

According to documents released by the Financial Crisis Inquiry Commission (FCIC), at the time of Lehman Brothers’ bankruptcy it had more than 900,000 derivative contracts outstanding and had used the largest banks on Wall Street as its counterparties to many of these trades. The FCIC data shows that Lehman had more than 53,000 derivative contracts with JPMorgan Chase; more than 40,000 with Morgan Stanley; over 24,000 with Citigroup’s Citibank; over 23,000 with Bank of America; and almost 19,000 with Goldman Sachs.

Below is a share price chart of what derivatives contagion looked like on Wall Street in 2008.

So why was Michael Barr not talking about 2008, Lehman Brothers, AIG or the insanely interconnected trading houses on Wall Street in his speech on Tuesday?

It’s because, as we reported on February 13, Barr has allowed five Wall Street mega banks to hold $223 trillion in derivatives today, 83 percent of all derivatives at 4,600 banks in the U.S.

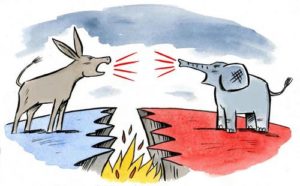

For more than two decades, both Republican and Democratic administrations in Washington have shown a sycophantic subservience to tolerating the catastrophic level of derivatives at the Wall Street mega banks while simultaneously allowing them to own federally-insured, taxpayer-backstopped commercial banks.

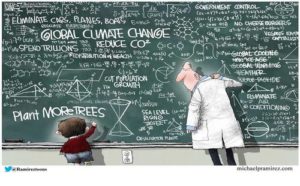

This sycophantic tolerance has existed despite repeated warnings from academics and federal researchers. As far back as 2016, researchers have been sounding the alarms on counterparty risk and the failure of the Fed’s stress tests to properly measure that risk.

In a report issued in March 2016 by the Office of Financial Research (OFR), a federal agency created under the Dodd-Frank financial reform legislation of 2010, the OFR brought the illusory nature of the Fed’s oversight of counterparty risk into focus.

The OFR researchers who conducted the study, Jill Cetina, Mark Paddrik, and Sriram Rajan, found that the Fed’s stress tests are measuring counterparty risk for the trillions of dollars in derivatives held by the largest banks on a bank by bank basis. The real problem, according to the researchers, is the contagion that could spread rapidly if one big bank’s counterparty was also a key counterparty to other systemically important Wall Street banks. The researchers write:

“A BHC [bank holding company] may be able to manage the failure of its largest counterparty when other BHCs do not concurrently realize losses from the same counterparty’s failure. However, when a shared counterparty fails, banks may experience additional stress. The financial system is much more concentrated to (and firms’ risk management is less prepared for) the failure of the system’s largest counterparty. Thus, the impact of a material counterparty’s failure could affect the core banking system in a manner that CCAR [one of the Fed’s stress tests] may not fully capture.” [Italic emphasis added.]

In Barr’s speech on Tuesday, he stated that “…alongside this year’s stress test results, we will publish the aggregate results of several exploratory analyses, including analysis of the resilience of the globally systemically important banks to the simultaneous default of their five largest hedge fund counterparties.”

But according to an OFR study released in July 2021, it’s not hedge funds where banks have the largest counterparty risk. It’s corporations.

For just how long this insidious behavior between the Fed and the Wall Street mega banks has been going on, we suggest reading the seminal book on the subject, Arthur Wilmarth’s Taming the Megabanks: Why We Need a New Glass-Steagall Act.

Our Shave Bars will produce a thick foam when used with a Shaving Brush. They are gentle and produce a smooth creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. And no single-use packaging waste. Each bar will last about 2 to 3 times longer than regular shave products.

These bars give a very close and smooth shave with no razor burn. They leave your skin feeling amazing. A lather can be built up in your hands and then applied to your face, but it is best to use a shaving brush.

Our Shave Bars are made with skin loving ingredients including palm stearic acid, coconut oil, shea butter, cocoa butter, castor oil, and glycerin. Scented only lightly with fragrance or essential oils.

You choose a scent:

Samples give you a chance to try before you buy. You will receive two random scent samples, unless you specify which ones you would prefer. Each sample will weigh approximately 0.5 ounces.

A Thousand Dreams is a whimsical blue scented in a warm mix of fruity and floral notes with peach, peony, lily, musk, sandalwood, and amber.

Bay Rum Spice is a nice masculine scent similar to Old Spice. The scent notes are clove, pine needles, cedarwood, orange, vanilla, and musk.

Birch Woods is a great outdoors-type scent. The notes are bergamot, patchouli, vetiver, and tonka bean.

Cool Clear Water is a refreshing scent. The notes are crisp water, oakmoss, pine, cedar, and musk.

Lavender Champagne has a wonderful scent of Lavender and Champagne and has a light purple color. The scent notes are lavender, sparkling Champagne, grapefruit, orange, thyme, oak, and amber.

Midnight Waters is a moody-mystical scent that opens with fruity notes of red berries, juicy tangerine, and bergamot. Then unfolds into bubbly Champagne, violet flowers, cashmere, amber, and musk.

Raspberry Vanilla is an all-time favorite fragrance for soap. It is a beautiful magenta color. The scent notes are raspberry, strawberry, lemon, coconut, peach, honeysuckle, plum, and vanilla.

Warm Sandalwood is a warm, rich, and woodsy scent. The colors are warm and rich with brown, gold, and white.

This listing is for 1 of our Shave Bars and 1 Shaving Brush. A bar will weigh approximately 3 ounces and be approximately 2.25 inches across and 1.25 inches thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured. The brush is made from natural badger hair with a wood handle.

Please keep your Shave Bar and Brush well-drained and allow to dry between uses. This will ensure a longer lasting bar. Buy Today

![]()