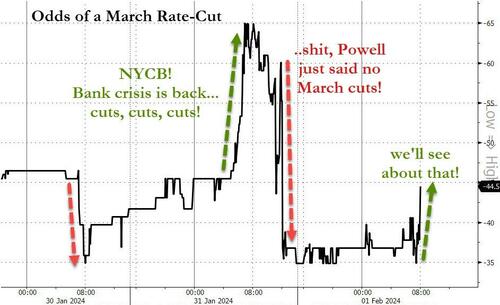

Yesterday it was NYCB that grabbed the headlines and spoiled Powell’s day.

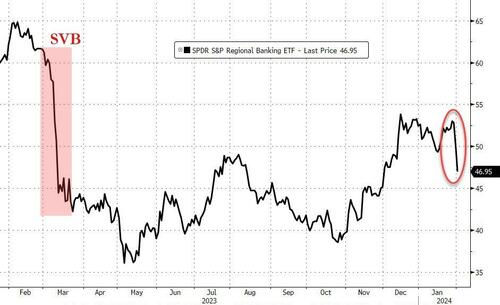

As we detailed here (and here), the banking crisis never went away and it now appears the rest of the market realizes that too as Regional Bank shares are extending their losses significantly today…

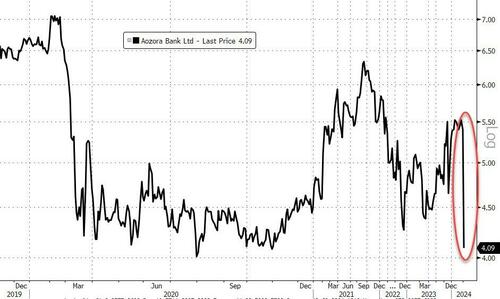

This morning saw the US CRE crisis go global as Aozora Bank faced the music on its balance sheet folly.

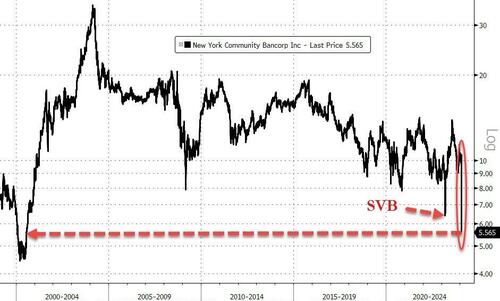

NYCB is extending losses (well below SVB lows)…

Western Alliance Bancorp is getting clubbed like a baby seal today…

Shares of Zions Bancorp, Comerica and Webster Financial are also tumbling along with Citizens Financial, Regions Financial, SouthState, Prosperity Bancshares, Schwab, PacWest, and Huntington Bancshares…

The market appears to be finally pricing in the end of the BTFP, and all the chaos that will ensue from that, as the risk perception has spread to the whole sector. Regional bank shares are puking hard today…

But, but, but, it was all looking so good, right? Regional bank shares had risen excitedly as talking heads reassured them that the ‘mini-banking-crisis’ was extinguished magnificently by The Fed…

All of which leaves us wondering… is the market starting a bank-run to call Powell’s bluff?

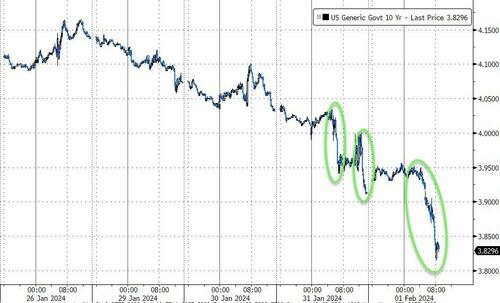

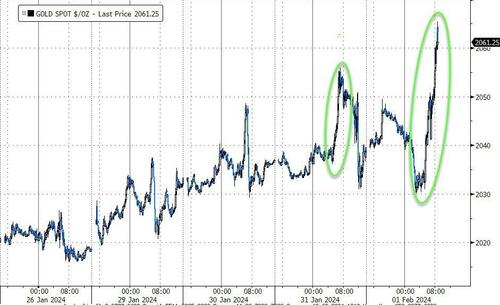

We’re also seeing a safe-haven, flight-to-quality bid for bonds and bullion

As a reminder, billionaire Barry Sternlicht warned yesterday that he sees more than $1 trillion of losses for office real estate, calling the properties “one asset class that never recovered” from the pandemic.

“The office market has an existential crisis right now,” which is largely a US phenomenon because workers haven’t gone back to their desks, Sternlicht said Tuesday at the iConnections Global Alts conference in Miami Beach.

Once a $3 trillion asset class, offices now are “probably worth $1.8 trillion,” said Sternlicht, chief executive officer of Starwood Capital Group.

“There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.”

Which acronym will replace BTFP and how many trillions will it inject?

the Fed removed the following sentence from the FOMC statement: “The US banking system is sound and resilient.” Cynics asked why the Fed no longer sees “the US banking system is sound and resilient” – is it a signal of rumblings in the economy near-term, or was it just a lie before, and now that bank dominoes are again falling, will Powell be forced to trot it back out?

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

To Get 20% Of Use Coupon Code Bankster20 Or HNews20

![]()