by Tyler Durden

A startling disconnect as we edge closer to the 2024 general election: On one hand, so-called “experts” parade optimistic economic reports, but for the average American, the story is starkly different.

In heated debates, economists squabble over whether the public is hoodwinking pollsters or if mysterious forces are at play.

Our guest columnist explains how the government is playing a smoke-and mirrors-game with the economy.

It’s more subtle than making up numbers.

They’re pumping up GDP and job figures through hefty spending and hiring. Unlike the struggling private sector, the government can spend tax dollars and create deficit-financed jobs without having to prove their worth:

The following article was originally published by the Mises Wire. The opinions expressed do not necessarily reflect those of Peter Schiff or SchiffGold.

As the 2024 general election gets closer, Democrats and proestablishment pundits are growing frustrated with the American public for not feeling as good about the economy as the so-called experts say they should. The elitism of this view aside, it is true that traditional economic indicators are pretty good and that, at the same time, people aren’t feeling good about the economy.

Center-left economists have been locked in a debate over whether people are lying to pollsters about experiencing hardship in what is actually an excellent economy or are struggling due to mysterious noneconomic factors.

Others, like Paul Krugman, have decided to blame Donald Trump and his supporters—framing the widespread economic pessimism as a MAGA ploy to win back the White House—a theory Jonathan Newman showed is disproven by the very data Krugman cites.

So, what’s really going on here?

Daniel Lacalle laid the truth out well in his recent appearance on Radio Rothbard. In short, the government is making the economy look a lot better than it is.

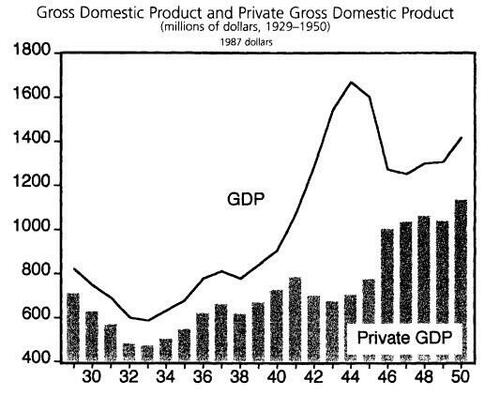

Those who argue the economy is doing great usually cite economic growth as measured by gross domestic product (GDP) and various measures of the employment rate.

And while on the surface it seems to make sense to use these indicators to get an idea of how the economy is faring overall, there’s one big problem.

None make any serious distinction between private economic activity and government spending.

But there is a big difference between the two.

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant.

It’s the private sector that’s responsible for producing goods and services that actually meet people’s needs and wants. So, the private components of the economy have the most significant effect on people’s economic well-being.

And according to Lacalle, the private sector of the US economy is already experiencing a recession. However, the high levels of government spending are artificially boosting the GDP above the technical recession threshold. Similarly, government hires have featured disproportionally in the recent seemingly positive jobs reports.

That’s why we’re seeing a divergence between the positive economic data in the headlines and the more negative sentiments of the American people. It’s not a mystery, and it’s not fake news or partisanship. It’s the government.

But don’t expect any politicians, center-left economists, or proestablishment pundits to admit it. All insist the government can boost economic growth and employment—especially during times of war. Take, for instance, the myth that World War II brought an end to the Great Depression. What happened back then is similar to what we’re dealing with now, albeit on a much larger scale. The government spent and hired enough not only to hide the destructiveness of the war, but also to make it appear like a good thing for the economy.

That is the same trick at play today. Because the government printed trillions of dollars to hide the economic damage of the covid lockdowns, a tremendous amount of malinvestment has locked in a major market correction. Now, as the economy begins to falter, the government is again spending and hiring on a massive scale to keep up the illusion of a strong economy.

But most Americans can tell something’s off. And they’re right.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

To Get 20% Of Use Coupon Code Bankster20 Or HNews20

![]()