By Pam Martens and Russ Martens: January 18, 2024 ~

On February 10, 2014, the non-profit watchdog, Better Markets, took a bold and historic action. It filed a federal lawsuit against the highest law enforcement agency and officer in the United States – the U.S. Department of Justice and the man who sat at its helm, Attorney General Eric Holder.

The lawsuit challenged a $13 billion out-of-court settlement that had been agreed to by the Justice Department and the Wall Street mega bank, JPMorgan Chase, over its sale of toxic mortgages. Better Markets wrote on its website that this was at the time “The largest settlement in U.S. history from a single entity by more than 300%” and that it “granted JP Morgan blanket civil immunity for years of alleged, but undisclosed, pervasive, egregious and knowing fraudulent and illegal conduct that contributed to the 2008 financial crash and the worst economy since the Great Depression.”

Among the many eyebrow-raising allegations in the Better Markets’ press release, these three stood out:

“The Attorney General and other senior DOJ political appointees negotiated directly and entirely in secret with the CEO of JP Morgan Chase [Jamie Dimon], someone who was considered a possible Treasury Secretary just a few years ago.

“The cellphone of DOJ’s third highest ranking official rang with the ‘familiar’ phone number of JP Morgan Chase’s CEO [Jamie Dimon], who called to offer billions of dollars to stop DOJ from holding a press conference and filing a lawsuit in just a few hours. The call worked, and the press conference and lawsuit were both called off.

“DOJ gave complete civil immunity to JP Morgan Chase for defrauding thousands in exchange for $13 billion, via a contract that was negotiated and finalized in secret without any review or approval by a federal court.”

Attorneys for the Justice Department asked the federal court to dismiss the Better Markets lawsuit on the basis that Better Markets lacked standing to file the lawsuit. The U.S. District Court for the District of Columbia did just that in a longwinded decision that effectively stripped Americans of their ability to fight back against the increasingly corrupt nexus between Washington and Wall Street.

We reached out this week to Better Markets’ President and CEO, Dennis Kelleher, to explain how federal courts can get away with this type of cronyism. He responded as follows:

“Unfortunately, the U.S. legal system is an unlevel playing field tilted in favor of Wall Street’s banks/Corporate America and against Main Street Americans/the public interest. That’s because judges require anyone bringing a lawsuit to show ‘standing’ to file a case, which almost always depends on a plaintiff showing quantifiable, concrete, and specific if not unique harm. Because banks/Corporate America can always show or make up some dollar amount of injury from a government action or rule, they virtually always have standing to sue. But Main Street Americans/the public interest almost always cannot because public harm usually is not quantifiable, concrete, specific or unique to a particular plaintiff.

“For example, even if it was objectively true that the DOJ/Eric Holder sold out to JPMorganChase/Jamie Dimon, Better Markets’ case would have been thrown out because the harm from that sell out would be to everyone in the country and not a quantifiable, concrete, specific, or unique harm to Better Markets. The same is true if an agency like the CFTC or SEC knowingly enacted a rule that unlawfully favored the financial industry. Public interest groups or just ordinary citizens would likely get thrown out of court if they sued unless there was some unique harm inflicted. Put differently, while there are some exceptions, as long as the harm is to the broad public interest you basically cannot sue to protect the public interest.”

If this sounds like the Kafkaesque court logic of a vast wealth transfer conspiracy, you’re thinking along the right lines.

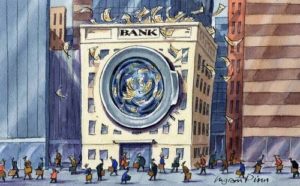

Better Markets’ Graphic from Press Conference Announcing Lawsuit Against the DOJ

Take a closer look at the graphic that Better Markets presented at its press conference announcing the lawsuit. What it effectively shows is a money laundering operation where a recidivist bank pays $13 billion to a federal agency in the executive branch of government; bypasses the judicial branch of government; and walks away with immunity and no questions asked. If that feels more like a banana republic form of justice than that of a thriving democracy, welcome to the new world of kleptocracy in America.

Nine months after Better Markets had filed its lawsuit, its worst suspicions about the secret backroom deal materialized in the pages of Rolling Stone under the byline of Matt Taibbi. The Justice Department had silenced the perfect eyewitness, Alayne Fleischmann, a former attorney at JPMorgan Chase who had reported the wrongdoing to her superiors. What Fleischmann described to Taibbi was “massive criminal securities fraud” within the bank. Taibbi describes what happened to Fleishmann as follows:

“Six years after the crisis that cratered the global economy, it’s not exactly news that the country’s biggest banks stole on a grand scale. That’s why the more important part of Fleischmann’s story is in the pains Chase and the Justice Department took to silence her.”

The Justice Department announced its $13 billion civil settlement with JPMorgan Chase on November 19, 2013. At the time, it clearly knew that it would be bringing stunning criminal charges against the same bank just 49 days later.

On January 7, 2014, the Justice Department shocked the country with the announcement that the largest federally-insured bank in the U.S., JPMorgan Chase, had played a key role in the largest Ponzi scheme in history – that of Bernie Madoff. And because the bank hid its suspicions from U.S. law enforcement that a Ponzi scheme was occurring and failed to file the legally-mandated Suspicious Activity Reports, the Justice Department charged the bank with two criminal felony counts.

But instead of prosecuting the case in a federal court, where the disgusting details would play out in newspaper headlines for months, the Justice Department allowed the bank to admit to the charges and walk away with a hefty fine and a two-year deferred prosecution agreement; meaning that if the bank did not violate its two-year probation, it would never be prosecuted for these crimes.

Since 2014, this kind of backroom deal between JPMorgan Chase and the Justice Department has become enshrined as the new standard for crony justice between Wall Street and Washington. JPMorgan Chase has racked up five felony counts, received three deferred prosecution agreements and two non-prosecution agreements. (See the highlights of its breathtaking rap sheet here.)

And yet, there is zero indication that JPMorgan Chase’s appetite for crime as a business model has been satisfied. The Attorney General of the U.S. Virgin Islands last year brought credible evidence into federal court in Manhattan that JPMorgan Chase “actively participated” in Jeffrey Epstein’s sex trafficking of minors by ignoring a decade of his money laundering inside the bank – the very money laundering conduct that resulted in the bank admitting to two felony counts in 2014 in the Madoff case. In both matters, the bank failed to file the legally mandated Suspicious Activity Reports with the Financial Crimes Enforcement Network (FinCEN) despite internal communications showing it was well aware that the financial transactions were highly suspicious.

Despite the Justice Department and FBI sitting on reams of evidence in the Jeffrey Epstein/JPMorgan case since 2008, the DOJ has brought no criminal charges against the bank related to Epstein.

Notwithstanding this unprecedented crime wave at JPMorgan Chase, and the ability of Jamie Dimon to not only remain at the helm of the biggest bank in the U.S. but to become a billionaire from the stock options lavished on him by his Board, federal regulators again proved themselves to be the lapdogs that millions of Americans suspect them to be when they allowed JPMorgan Chase to get $200 billion bigger last year.

George Washington University Law Professor, Art Wilmarth, author of Taming the Megabanks: Why We Need a New Glass-Steagall Act, explained during the Better Markets conference in September of last year exactly what transpired in the spring of 2023 when regulators handed JPMorgan Chase the collapsed bank, First Republic:

“…When First Republic failed, regulators did not invoke the systemic risk exception. That was a clear and rather shocking error in my opinion. They accepted JPMorgan’s bid to buy most of the assets and assume all of the deposits of First Republic.

“By the way, JPMorgan recorded a profit of almost $3 billion on that transaction. The Deposit Insurance Fund has recognized a loss of at least $13 billion and it may be larger on that transaction. That’s a hard result to justify and I don’t think the FDIC has attempted to justify it and I don’t think they can…

“So what they did was to impose a loss of $13 billion on the Deposit Insurance Fund, which must be reimbursed by all the banks, not just the big ones, not even the banks larger than $5 billion – all the banks – meanwhile handing JPMorgan a $3 billion profit; increasing JPMorgan’s size by more than $200 billion and allowing JPMorgan to grow to a size of more than $4 trillion. By the way, also waiving any anti-trust review because First Republic Bank was a failed bank, so there was no anti-trust review.”

If this is not the kind of “democracy” that you want to leave to your children and grandchildren, pick up the phone today and call your U.S. Senators’ office and demand the appointment of a Special Counsel to investigate these backroom deals between the Justice Department and JPMorgan Chase.

Treat your skin well. Our soaps are gentle and produce a smooth, creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. GraniteRidgeSoapworks

![]()