Jamie Dimon Calls Bitcoin “Shit” Because He Confuses It With Fiat Money

by Tyler Durden

A lot has changed since 2017. Back then, in what was the first recorded comments by Jamie Dimon on the topic of bitcoin and crypto, the JPM head was not shy to let the world know how he felt: back then, Dimon said the cryptocurrency “won’t end well” predicting it will eventually blow up, and called it “a fraud” and “worse than tulip bulbs.” If that wasn’t enough, Dimon also said that if a JPMorgan trader began trading in bitcoin “I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

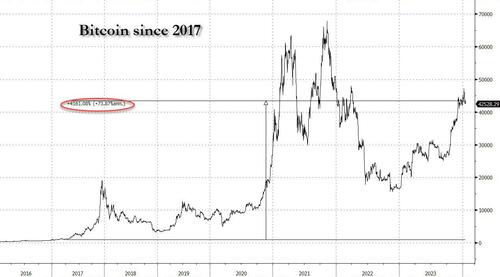

Oh boy… where to begin: first of all, not only has bitcoin not ended badly, it hasn’t ended at all. In fact, since 2017 bitcoin is up over 4000%, making it the single best performing asset class in the world, if not history.

Also, unlike “tulip bulbs”, bitcoin has gone through not one, not two but at least three cycles already and has yet to be shown to be a bubble, let alone one that has burst. In fact, unlike banks which get a regular bailout from the Fed any time there is bank run contagion or a stock price crash, the crypto universe has survived everything that central banks and regulators have thrown at it, and prices are at multi-year highs. As for firing any JPMorgan trader who trades bitcoin, well, not only is Jamie now rewarding bitcoin traders at JPMorgan – which now has a dedicated crypto/bitcoin research section as well as dedicated crypto client coverage and trading desk – but the bank recently became the broker-dealer to iShares Bitcoin Trust, the ETF of the world’s largest asset manager.

So yes, a lot has changed since 2017, even if Jamie’s epic hypocrisy has remained largely unchanged. We say that because earlier today, the CEO of the largest bank popped up on the CNBC Davos livestream where he did – what else – bash bitcoin.

Responding to Andrew Ross Sorkin’s question about his thoughts on bitcoin now that the SEC has finally approved an ETFs as a result of relentless pressure from Blackrock, Jamie gave a somewhat coherent answer, responding that “Blockchain is real, it’s a technology, we use it. It is going to move money, it is going to move data, it is efficient. We have been talking about that for 12 years, i think we have wasted too many words on that.”

Then, turning to cryptocurrencies, Dimon said that “there’s two types. There is a cryptocurrency which might actually do something. Think of it as using it to buy and sell real estate, move data.” In other words, “Tokenizing things that you do something with”; here Dimon is envisioning a smart contract like Ether, which is something even he approves of (following Larry Fink’s recent vocal endorsement of ETH). And then, Dimon goes on, there is the crypto “which does nothing. I call it the pet rock, the bitcoin, or something like that. And so on the bitcoin, you know, there are use cases, fraud, antimoney laundering, tax avoidance, sex trafficking, those are real use cases and you see it being used for maybe $50, $100 billion a year for that. That is the end use case everything else is people trading among themselves.”

So far it’s mostly the usual song and dance from the CEO, although at this point, we find a clear shift in Dimon’s sentiment toward bitcoin: whereas 7 years ago he would have fired any of his employees trading it, this time – sensing the shift in sentiment across Wall Street – says that “I defend your right to do bitcoin. I don’t want to tell you what to do, so my personal advice is don’t get involved but i don’t want to tell any one of you to do, it is a free country.“

Sorkin, however, refuses to let up and after pushing Dimon why Blackrock and Larry Fink changed their view on Bitcoin, Dimon erupts “just please stop talking about this shit. I don’t know what he would say about blockchain versus currencies that do something versus bitcoin that does nothing. That’s what makes a market people have opinions.”

Well, at least he still thinks bitcoin is shit, even though his bank is directly making millions from it as for this moment.

Still, we may have finally had a breakthrough into why Dimon thinks bitcoin is shit: as he explains in the following exchange, Jamie harbors the bizarre belief that Satoshi will magically re-appear and increase the supply of bitcoin over the 21 million to which it is structurally limited.

https://platform.twitter.com/embedYes, the CEO of the largest US bank believes that bitcoin supply will magically expand once it hits its limit, even though as so many were quick to explain, the digital currency is literally five lines of code and nobody, not even Satoshi, can change it.

So while we marvel at Jamie’s confusion on the most basic premise of bitcoin, at least we now understand what the basis of his hatred for bitcoin is: you see, it’s not bitcoin that Jamie hates, he hates the risk that someone – Satoshi or whoever – can just push a button and boost supply.

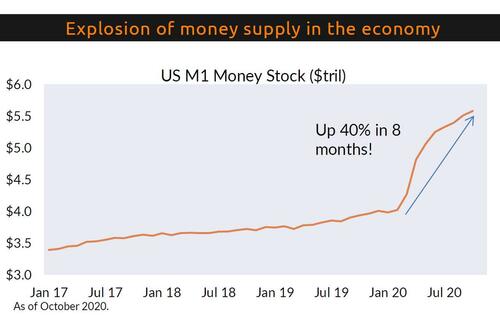

Well, Jamie, we have some news for you: what you are so worried about, and what is the source of all your loathing, is not bitcoin but fiat money, aka US dollars… Remember those? Remember when the US government and the Fed printed 40% of all US dollars ever created just in 2020? Yes, that was dollars, not gold, not bitcoin. Dollars.

Yes, Jamie, that’s the “shit” you are so worried about, not bitcoin, and it’s why after rising 4000% since you first lashed out at it, we expect a similar return over the next 7 years, at which point we are somewhat hopeful you will finally understand why you were so wrong all these years.

Watch the full Jamie Dimon CNBC clip below.