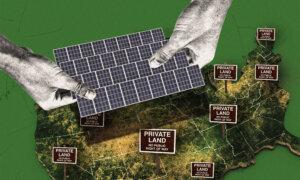

By making money off of the right to own both public and private land in the United States, Wall Street has discovered a new approach to combat climate change while simultaneously making a profit.

A Natural Asset Company (NAC) would be established by the New York Stock Exchange (NYSE) and an organization known as the Intrinsic Exchange Group (IEG). This new business structure would allow international investors to combine their funds to purchase U.S. land rights for “sustainable” projects.

Despite the abundance of environmentally conscious funds and charitable contributions aimed at protecting land, “investors still express an unmet need for efficient, pure-play exposure to nature and climate,” states a filing by the NYSE with the SEC.

Natural assets must be brought into the financial mainstream if we are to put an end to the overconsumption and underinvestment in nature, according to the NYSE.

By Kevin Stocklin|

Wall Street has found a new way to fight global warming and turn a profit in the process, by monetizing the right to control America’s public and private land.

The New York Stock Exchange (NYSE), together with an organization called the Intrinsic Exchange Group (IEG), have proposed setting up a new type of company called a Natural Asset Company (NAC), which would pool investors’ money from around the world to buy the rights to land in the United States with the goal of restricting its use to “sustainable” endeavors.

According to the NYSE’s filing with the Securities Exchange Commission (SEC), despite the many options to invest in eco-friendly funds or donate to nonprofits for land preservation, “investors still express an unmet need for efficient, pure-play exposure to nature and climate.

“Ending the overconsumption of and underinvestment in nature requires bringing natural assets into the financial mainstream,” the NYSE states.

Seizing Private Land Is Next Step in Fight Against Climate Change

Climate Scientists Say We Should Embrace Higher CO2 Levels

The goal of this initiative is to turn the rights to use public land and water resources into financial instruments so that they can be bought, sold, and traded for profit.

“Healthy ecosystems produce clean air and water, foster biodiversity, regulate the climate, and provide the food on which our existence depends,” the NYSE filing states. “These and other benefits derived from ecosystems are called ecosystem services, and in the aggregate, economists estimate their value at more than US$100 trillion dollars per year.”

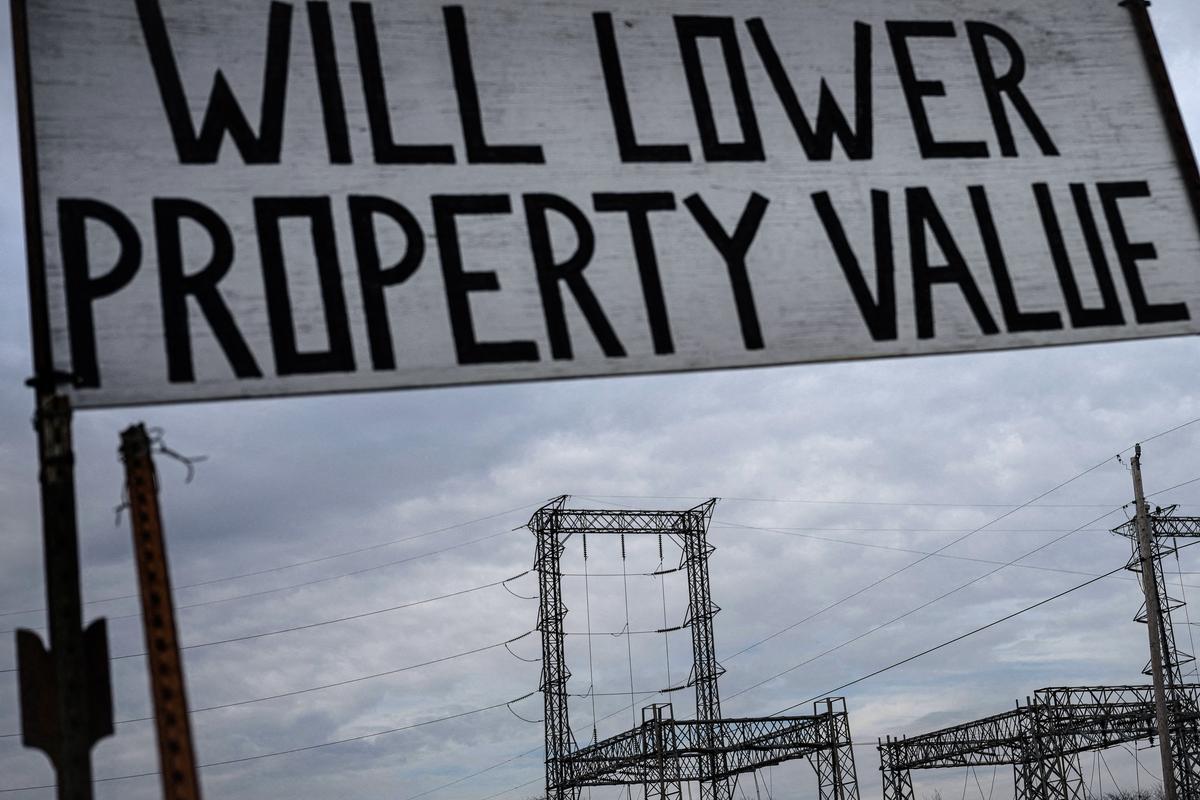

Investors may see dollar signs, but critics see a dark side.

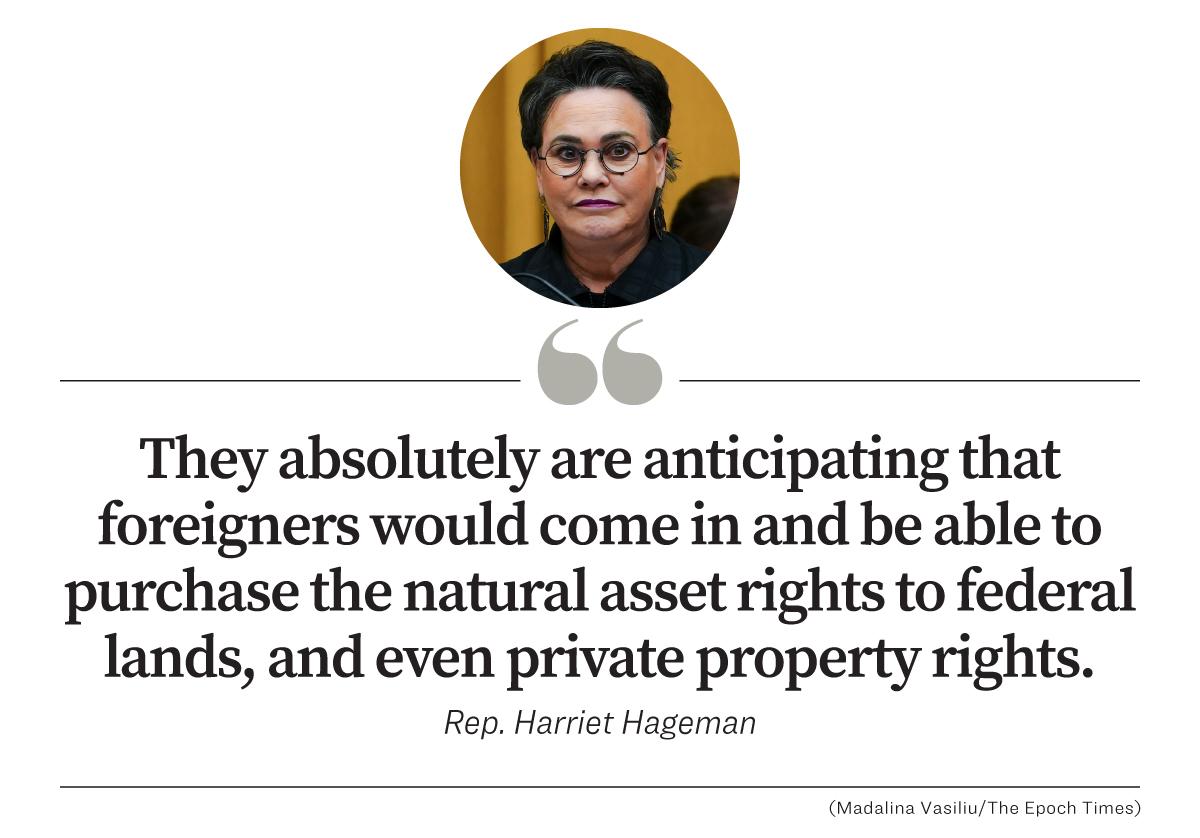

“It is an effort to impose another layer of control, and to securitize our national parks, our national forest lands, and some private properties throughout the entire United States,” Rep. Harriet Hageman (R-Wyo.) told The Epoch Times. “This is just a sneaky way to allow very wealthy people to control even more of our natural resources.

“They’re trying to sell this concept of having the right to exclude people from being able to use and access what is our legacy, our lands.”

The federal government owns nearly half of the land in Wyoming, Ms. Hageman’s home state.

In what critics say was a hushed and rushed process, the Securities and Exchange Commission (SEC) announced a rules change on Sept. 29, 2023, to allow the formation of these new and novel companies on the NYSE, allowing 21 days for public comment. The SEC scheduled its decision date for Jan. 2.

‘A Terrifying Prospect’

State officials, particularly in Western states where land is often majority-owned by the federal government, are expressing alarm about this plan.

“It is a terrifying prospect, because we look at this as a way for the federal government to lock up land in the state of Alaska against development and block future resource prospects,” Alaska’s Department of Revenue Commissioner Adam Crum told The Epoch Times. “This is a massive decision that’s going to affect the public trust and public lands forever, and we’re not getting proper time of response.

“To have the government pass off potentially a lot of our assets and claim it’s in our best interests is not a fun place to be.

“This is a very big deal, and for it to happen in such a quick way does not bring about confidence; it reeks of nefarious means.”

More than 60 percent of the land in Alaska is owned by the federal government. Mr. Crum joined with 21 other state financial officers in signing a letter to the SEC to protest both the establishment of NACs and the duration of the comment period.

“It was only 21 days, and for something this drastic, it should be much better notice,” Utah State Treasurer Marlo Oaks told The Epoch Times. “There needs to be serious discussion around this.

“We think of our natural resources as one of the critical assets we have, and North America has some of the richest natural resources in the world.

A part of the trans-Alaska pipeline system runs through boreal forest past Alaska Range mountains near Delta Junction, Alaska, on May 5, 2023. (Mario Tama/Getty Images)

“These Natural Asset Companies could effectively lock those away in perpetuity.”

On Dec. 15, 2023, Ms. Hageman and 31 other Congress members sent a letter to the SEC demanding an extension of the public comment period on NACs. On Dec. 21, the SEC agreed to extend its deadline and re-opened the comment period. The new deadline hasn’t yet been announced.

“They know that this is a real fleecing of American property rights, and so they’re trying to get it done quietly and quickly without any opposition or public attention,” Margaret Byfield, executive director of American Stewards of Liberty, a property rights nonprofit, told The Epoch Times.

“I think as more people take a look at this, they have a lot of questions, whether or not the action is constitutional.”

A Prohibition on ‘Unsustainable Activities’

According the NYSE proposal, the NACs would be established pursuant to an agreement in which IEG would create the investment vehicles and license its reporting software to them, and the companies would then be listed and traded on the exchange. Because “most ecosystem services are not monetized today [and] to capture the value of non-monetized ecosystem services,” IEG developed a proprietary reporting system to measure and value the natural assets, based on the United Nations System of Environmental-Economic Accounting rather than the standard U.S. Generally Accepted Accounting Principles.

Once NACs are set up, IEG would receive a share of the revenues earned by NYSE from listing them. The NYSE, in turn, took a minority interest in IEG, which was originally founded in 2017 by the Rockefeller Foundation and other investors.

According to IEG’s website, NACs are necessary because “the financing gap for biodiversity is estimated between [$598 billion and $824] billion per year, for climate change about US$5 trillion dollars per year, and for the transition to a more sustainable, resilient, and equitable economy, orders of magnitude larger.”

The NACs would be prohibited from allowing “unsustainable activities,” defined as actions that cause harm to ecosystems or “extract resources without replenishing them.” Unsustainable activities would include mining, drilling for oil, and industrial farming.

A solar panel range in a field that was previously used for agriculture, near Huron, Calif., on July 23, 2021. (Robyn Beck/AFP via Getty Images)

NACs could allow such activities as eco-tourism or regenerative agriculture. Whether sustainable activities could also include installing wind turbines, solar farms, or carbon-capture pipelines is unclear.

Some analysts of the plan say that they find it strange that the NYSE is venturing into politics.

David McIntosh, president of the Club for Growth Foundation, questioned why “the New York Stock Exchange—the largest stock exchange and the hallmark of free markets across the globe—is suddenly seeking to alter its rules to favor particular domestic policy goals.”

In an emailed statement to The Epoch Times, Mr. McIntosh wrote that “an exchange is not the proper vehicle for ideological advocacy … There is no financial, legal, or practical reason why conservationists should be investing on the NYSE rather than giving a tax-deductible contribution to a nonprofit.”

Critics of the NAC plan are also raising concerns that it could give control over U.S. lands to the ultra-wealthy and foreign interests.

“They absolutely are anticipating that foreigners would come in and be able to purchase the natural asset rights to federal lands, and even private property rights,” Ms. Hageman said, noting that China already owns 335,000 acres of farmland in the United States.

A Deficit of Democracy

U.S. public lands are divided into two main categories: Special Use, which are designated for preservation and include wildlife refuges, parks, and monuments, and Multiple Use, which allows farming, grazing, timber harvesting, mining, drilling, hunting, fishing, hiking, and other uses. While much of the Eastern United States, developed in the early years of the Republic, is privately owned, more than half of the land in Western states is government owned.

Efforts by the Biden administration under its “America the Beautiful Initiative” to restrict the use of public lands have raised issues of administrative overreach because the designation of public land falls under the authority of elected representatives in Congress.

“That’s why you see lawsuits when the Biden administration won’t lease, or they try to block access or use of, these lands,” Ms. Hageman said. “You’ll sometimes see courts issue orders saying, ‘You’re required by law to lease these lands.’

“That’s why Congress set them up in the first place.”

The NYSE filing states that the rights that NACs would own include farming rights, mineral rights, water rights, or air rights, and that “NACs are expected to license these rights from sovereign nations or private landowners.”

The missing piece of the puzzle is whether the Biden administration would attempt to sell or transfer these rights to private investors.

President Joe Biden delivers remarks at a conservation summit at the Department of the Interior in Washington on March 21, 2023. (Kevin Dietsch/Getty Images)

The NAC initiative coincides with President Biden’s 30×30 plan, according to which 30 percent of the United States’ land and freshwater areas and 30 percent of U.S. ocean areas would be set aside for conservation by 2030. This was announced in a January 2021 executive order, although many argue that Congress and voters should have a say in it.

According to an American Stewards of Liberty report, the Biden administration is also adopting the U.N.’s environmental accounting system as part of an effort to value the United States’ natural assets. The administration’s American Conservation and Stewardship Atlas, part of the 30×30 program, is an initiative to place a monetary value on the United States’ natural resources, the report states.

In January 2023, the Biden administration created the U.S. System of Natural Capital Accounting, which it describes as “a U.S. system to account for natural assets—from the minerals that power our tech economy and are driving the electric-vehicle revolution, to the ocean and rivers that support our fishing industry, to the forests that clean our air—and quantify the immense value this natural capital provides.”

Asked why eco-minded investors would choose NACs over simply donating money to nonprofit conservation trusts, Ms. Hageman said: “The nonprofits buying land for preservation can’t buy federal lands.

“These NACs apply to federal lands, our national parks, our forest service, and our [Bureau of Land Management] lands,” she said. “They also apply to private property that has conservation easements on it.”

Whether Congress can prevent the establishment of NACs is an open question.

“What is so troubling about this is that we’re seeing rules coming out of the administrative agencies that have tremendous impact and they have not gone through a traditional legislative process—it’s just rules by administrative fiat,” Mr. Oaks said.

“This is why comment periods are so important, but it’s important that they also listen to the people and not just bolt forward thinking that they know best.”

Critics of these efforts to acquire and monetize land fear that Americans’ wealth and political rights could be slowly shifting further to the government and to Wall Street.

The New York Stock Exchange in New York City on Nov. 24, 2020. (Spencer Platt/Getty Images)

“We could see the transfer of Americans’ property rights to the global elite and foreign adversaries, and we will lose our ability to control our nation,” Ms. Byfield said.

“Property rights are so essential to self-rule in America.

“Who owns the land and natural resources controls the nation, and in America that was supposed to be ‘We the People.’”

One of the significant uses of federal land is providing food. Public lands are used for farming and grazing of livestock.

The push for the wealthy to control land use through NACs is coming at a time when organizations such as the United Nations and the World Economic Forum are decrying things such as eating meat, and billionaires such as Bill Gates are investing heavily in farmland and companies that manufacture meat-alternative foods, such as Impossible, Beyond Meat, and Upside Foods.

People in Western countries, Mr. Gates said in a 2021 interview, “should move to 100 percent synthetic beef … You can get used to the taste difference, and the claim is they’re going to make it taste even better over time.”

According to the IEG website, “managing resources wisely is as valuable, or perhaps even more valuable, than the food production.”

In addition to ecological goals, the NACs would also have social justice pursuits. According to the NYSE, NACs must include “an environmental and social policy, a biodiversity policy, a human rights policy, consistent with the United Nations’ Guiding Principles on Business and Human Rights, and an equitable benefit sharing policy.”

In response to a request for comment, the SEC stated that the NAC proposal came from the NYSE and specified the SEC’s procedures for approving such proposals, but it otherwise declined to comment. The NYSE provided a copy of its NAC filing but otherwise declined to comment.

The Intrinsic Exchange Group didn’t respond to a request for comment by press time.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

![]()