This Is Not Sustainable, Were Watching What the World Is Now Calling the Great Reset

(Reality–New World Order Pukes ) Our President Knows the End Is Near With the Current Financial Apparatus… The U.S. government…

![]()

Banks Are In Trouble: Wells Tumbles As Revenues Plunge, NIM Hits Record Low, Warns On Payment Deferrals

If there is one constant during earnings season, it is that no matter what the other banks do, Wells Fargo…

![]()

No Stimulus, No Problem: One Bank Sees “No Armageddon” Without A New Stimulus Deal

In recent weeks, many have opined – this website included – that with the US economy careening into a double dip recession…

![]()

The Pandora’s Box Of Fed’s Digital Currency Will Ignite An “Inflationary Conflagration”

We most recently described the Fed’s stealthy plan to deposit digital dollars to “each American” during the next crisis as…

![]()

Citigroup Hit With $400 Million Fine Over AML Failures That Led To Mike Corbat’s Downfall

The Comptroller of the Currency has finally handed down its punishment for the compliance failures that helped bring about an…

![]()

World’s Top Oil Trader Is Now A Used Car Salesman

Vitol Group, the world’s largest independent oil-trading firm, has been startled by the prospects of peak oil demand as it…

![]()

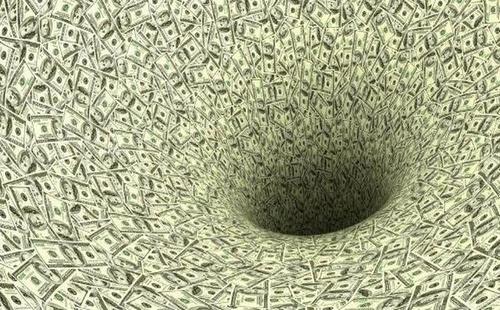

De-Dollarization Trend Remains Intact

Global de-dollarization resumed in the second quarter according to data recently released by the International Monetary Fund (IMF). While the dollar share of…

![]()

The SEC Is Making Deutsche’s CEO Personally Responsible For Bank’s Crimes

Since launching its last major international expansion push in the late 1990s, Deutsche Bank has become knonw – particularly over…

![]()

“Digital Euro” as It Begins Experiments on Digital Currency Launch — the Banking Industry Is Very Concerned Digital Currency Will Kill the Banking Industry

As the world obsesses over Trump’s taxes or whether or not he is using oxygen during his covid hospitalization, the…

![]()

Financialization & The Road To Zero, Part 1: The Evolution Of Commerce

This is Part 1 of a 4-part series. fi·nan·cial·i·za·tion /fəˌnanCHələˈzāSHən, fīˌnanCHələˈzāSHən/ noun The process by which financial institutions, markets et…

![]()