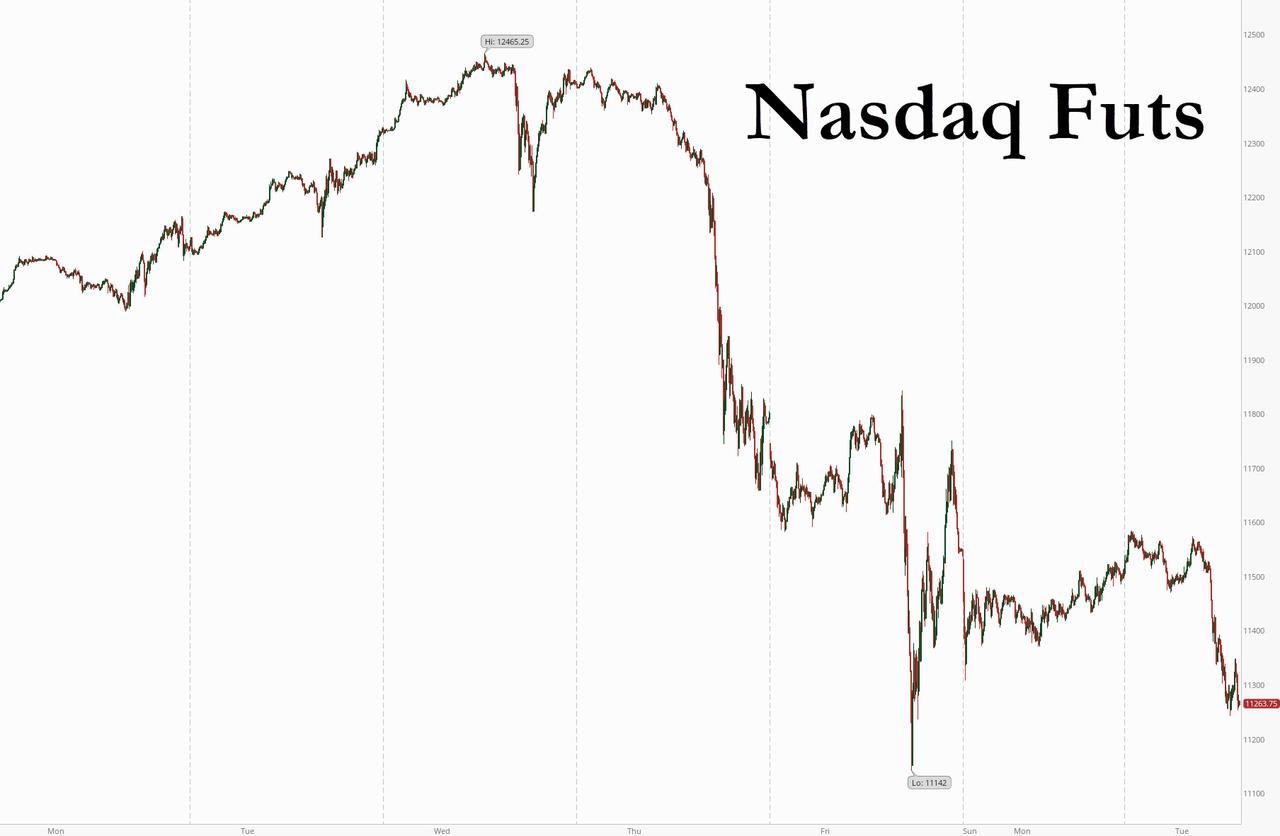

If SoftBank’s presence in the public markets was enough to send global markets to 9 consecutive all time highs while stretching tech valuations to unprecedented levels, then it is to be expected that SoftBank’s unwind of its notorious “Nasdaq Whale” trade as we reported yesterday, would send risk tumbling and sure enough Nasdaq futures plunged over 2% on Tuesday, leading a drop in European stocks and S&P futures, while the dollar jumped as the euro dropped and the pound weakened for a fifth day amid Brexit fears.

After U.S. markets were shut on Monday for Labor Day, S&P 500 futures fell more than 1% reversing gains made in Asian hours, while futures in tech-heavy Nasdaq fell 1.3% after having lost more than 6% late last week. The tech drop was led by Tesla, which plunged over 12% – now trading below Friday’s low – after it failed to make the S&P500 on Friday, having lost a third of its value in the past week dropping to $366 this morning after hitting an all time high of $538.75 last Tuesday…

… while AAPL slumped 3.5% after Goldman analyst Rod Hall said the shares look risky, as the company’s growth potential doesn’t appear strong enough to justify the stock’s valuation, saying “the iPhone is a very tough act to follow,” while Apple’s Services and Wearables businesses are “not likely to be large enough to return the company to growth.”

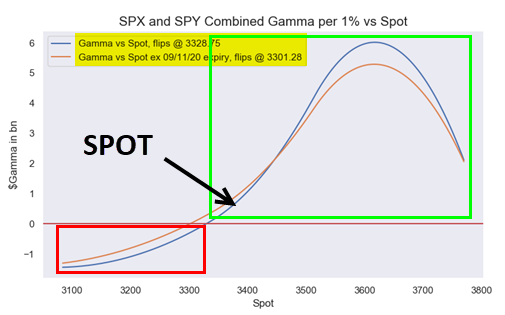

And here is what happens when a Nasdaq whale exits the market: as Nomura’s Charlie McElligott shows, as of this moment dealer gamma is about to turn negative after being torn apart by Masa Son for the past month. This means that any continued Emini selling is about to become reinforcing.

As a result traders are bracing for another ugly equity day, as Nasdaq 100 futures are down over 2% and S&P 500 contracts are steadily declining to fresh lows.

“The path of least resistance for the market may well be to test the downside,” said Peter Chatwell, head of multi-asset strategy at Mizuho International Plc. “Ultimately, if there is more selloff, I suspect real money investors will take the opportunity to buy the dip.”

Traders also braced for fresh tensions between Washington and Beijing after U.S. President Donald Trump again raised the idea of decoupling the U.S. and Chinese economies to end America’s reliance on the country. Trump also threatened to punish any American companies that create jobs overseas, and to forbid those that do business in China from winning federal contracts. Trump’s remarks followed the possible U.S. blacklisting of China’s largest chip maker, Semiconductor Manufacturing International Corp (SMIC), which has hit many Chinese tech firms listed onshore and offshore.

“I think the market will shrug this off as electioneering but may find the lining up of technology stock sellers harder to process as the U.S. market returns from a holiday yesterday,” said Chris Bailey, European Strategist at Raymond James.

World shares fell 0.2% in early trade, following gains in Asia overnight and a negative start in Europe, where fresh pressure on tech stocks dragged the STOXX 600 benchmark down 0.9% following strong gains on Monday: the FTSE MIB dropped over 1.5% to underperform peers, local back shed 1.4%. Travel, tech and oil & gas names weigh. In the UK, Royal Mail Plc, the privatized British postal service, surged 15% after saying it wants to overhaul its business and shift service to the parcels market.

Earlier in the session, Asian stocks gained, led by IT and finance, after falling in the last session. The MSCI’s index of Asia-Pacific shares outside Japan rose 0.4% and Japan’s Nikkei ended up 0.8%. China’s blue-chip index and Hong Kong’s Hang Seng meanwhile gained 0.5% and 0.2% respectively, both erasing early losses made after Trump’s remarks. The Shanghai Composite Index rose 0.7%, with Shandong Xinchao Energy and Sichuan Hebang Biotech posting the biggest advances. Australia’s S&P/ASX 200 gained 1.1% and South Korea’s Kospi Index rose 0.7%, while Thailand’s SET dropped 1.2%. The Topix gained 0.7%, with Fuji Pharma and Scinex rising the most. After slumping as much as 5% earlier in the session, SoftBank shares closed just barely in the red as traders reassessed the company’s (non) exposure to derivative positions.

In rates, the 10-year U.S. Treasury yield stood at 0.684%, off a five-month low of 0.504% touched in August. Yields were lower by more than 3bp at long end, flattening 5s30s by 1.5bp, 2s10s by 2.2bp; 10-year yields around 0.69% with gilts outperforming by ~1bp. Treasuries bull-flattened despite a wave of coupon and corporate supply expected this week. Risk-aversion is widespread, with European stocks and U.S. futures lower led by technology companies and oil down more than 5%. Gilts outperform and the pound weakened for a fifth straight day on Brexit concerns. The US Treasury auction cycle starts with $50BN 3-year notes (+$4b vs previous) at 1pm ET, followed Wednesday and Thursday by $35b 10-year and $23b 30-year reopenings (+$6b and +$4b vs previous reopenings).

Price action in FX dominated the European morning, as an early slump in USD reverses, resulting in a broad move toward the dollar in G-10 and EMFX. NOK and GBP are the worst G-10 performers; cable was weighed down by renewed Brexit discord and plans for a tighter limit to home gatherings due to a surge in virus cases. ZAR drops 1% after 2Q GDP fell an annualized 51% q/q alongside downbeat comments from Fitch. The EURUSD continued to drop, and after hitting 1.20 last week – a level which prompted aggressive verbal intervention from the ECB – the pair slumped as low as 1.178 this morning, in line with our expectations. For the Euro, the main focus on this week’s ECB policy meeting, where most analysts do not expect a change in the central bank’s policy stance but are looking at its inflation forecasts and whether it seems concerned by the euro’s strength.

“Rangebound trading will likely remain predominant until Thursday when the ECB meets,” UniCredit analysts said in a note.

Sterling fell to a two-week low against the dollar after the European Union told Britain on Monday there would be no trade deal if London tries to override the Brexit divorce deal it signed in January. The pound slipped more 0.3% at $1.3135 while against the euro it touched 0.90 pence, also a two-week low.

In commodities, Oil fell below $42 a barrel, its fifth session of decline, pressured by concerns that a recovery in demand could weaken as coronavirus infections flare up around the world. Meanwhile WTI futures fell even more, dropping 5.4% to $37.63 per barrel. Meanwhile, gold prices softened on Tuesday, although rising doubts over the economic recovery from the COVID-19 slump limited losses. Spot gold last traded at $1,912.83 per ounce.

Market Snapshot

- S&P 500 futures down 1% to 3,375.25

- STOXX Europe 600 down 0.9% to 364.77

- MXAP up 0.4% to 171.51

- MXAPJ up 0.3% to 565.99

- Nikkei up 0.8% to 23,274.13

- Topix up 0.7% to 1,620.89

- Hang Seng Index up 0.1% to 24,624.34

- Shanghai Composite up 0.7% to 3,316.42

- Sensex up 0.5% to 38,619.40

- Australia S&P/ASX 200 up 1.1% to 6,007.84

- Kospi up 0.7% to 2,401.91

- Brent futures down 1.5% to $41.37/bbl

- Gold spot down 0.3% to $1,928.29

- U.S. Dollar Index up 0.4% to 93.12

- German 10Y yield unchanged at -0.463%

- Euro unchanged at $1.1817

- Italian 10Y yield rose 3.0 bps to 0.92%

- Spanish 10Y yield rose 0.4 bps to 0.356%

A Look at global markets courtesy of NewsSquawk

Asian equity markets traded mostly positive, following the upbeat performance in EU counterparts given the lack of handover from US due to Labor Day, but with gains in the region moderated by inconclusive data and after US President Trump suggested the idea of decoupling the US economy from China. ASX 200 (+1.1%) attempted to reclaim the 6,000 level with Healthcare and real estate frontrunning the advances despite mixed data which showed Business Confidence slightly improved but remained in negative territory. Nikkei 225 (+0.8%) was kept afloat as participants digested the better than feared revisions to Q2 GDP which still showed large contractions, while KOSPI (+0.7%) was boosted as index heavyweight Samsung Electronics gains on reports it is to produce Qualcomm chips for 5G phones. Conversely, Hang Seng (+0.1%) and Shanghai Comp. (+0.7%) underperformed after US President Trump upped the anti-China rhetoric in which he said he is thinking about the possibility of decoupling the US economy from China and that it would not lead to monetary losses, while he suggested that China either faces decoupling or massive tariffs. Furthermore, the US is considering a ban on cotton from China’s Xinjiang region over human rights concerns, and China unveiled an initiative to set global data security regulations in an effort to counter US attempts of banning Chinese technology from other countries. Finally, 10yr JGBs were higher in a continuation of Monday’s rebound with prices unfazed by the mostly positive risk tone and with today’s 5yr JGB auction results somewhat inconsequential as it printed relatively inline with the prior.

Top Asian News

- Jump in Hottest H.K. IPO Reshapes Landscape of China’s Richest

- Bank of Thailand Chief Plays Down Possibility of More Rate Cuts

- Currency Decoupling From Virus-Hit Economy to Bank of Israel

- Thailand Says Revised Gold Trading Rules to Shield Baht Due Soon

Stocks in European have given up the mild gains seen at the cash open and some more (Euro Stoxx 50 -0.8%), as the region failed to sustain the positive APAC lead. US equity futures have also been sliding, with losses more pronounced in NQ as the tech unwind continues – with Apple down almost 3%, Amazon -1.7%, Netflix -2.5% and Tesla -10%. Back to Europe, sectors have somewhat solidified a defensive bias as the US tech downturn has reverberated into the region, with IT the standout underperforming sector; whilst the cushioned healthcare sector sees Switzerland’s SMI (-0.3%) the winner in Europe, but subdued nonetheless. Travel & Leisure also experiences steep losses as easyJet (-6.2%) shares plumb the depths as it now expects to fly less than 40% of planned capacity in Q4 in a sign of reduced demand for travel. Thus, the likes of Ryanair (-2.3%), Lufthansa (-1.9%) and Air-France KLM (-1.6%) are lower in sympathy. In terms of other movers and shakers, Royal Mail (+17.8%) shares top the charts after a trading update in which it reported bolstered business from its parcel deliver service. Swiss Re (+1.7%) is propped up by an update in which it sees a positive outlook for renewals and further market hardening. Volkswagen (-1.2%) is softer as the CEO said they are not seeking a deal with Tesla after a meeting with Elon Musk. Apple (AAPL) are to begin initial production of 5G iPhones in mid-September, reducing the production delay to weeks instead of months, according to Nikkei sources. (Nikkei)

In FX, the Dollar is holding a firm line in wake of Friday’s mostly encouraging labour report and yesterday’s Labour Day market holiday, with the DXY anchored around 93.000 awaiting the NFIB optimism index, employment trends and consumer credit alongside the return of Wall Street to see whether the tech sector correction continues to weigh on broader stock sentiment and keeps Treasuries elevated in futures terms.

- GBP – Yet more downside pressure and Sterling underperformance as no deal Brexit jitters intensify before the latest round of UK-EU trade negotiations amidst reports that PM Johnson is now questioning the Withdrawal Agreement and wants the deal to be rewritten. In response, Cable has given up the 1.3100 handle and has rebounded firmly beyond 0.9000.

- AUD – Somewhat mixed impulses via NAB’s August business survey, as confidence improved vs conditions deteriorating, but the Aussie may be deriving some traction or comfort from the latest jobs update given only a 0.4% decline in payrolls over the month to August 22, with a 2% drop in the state of Victoria and 0.1% increase elsewhere. However, Aud/Usd is drifting back from just over 0.7300, while Aud/Nzd is closer to 1.0900 than unusually hefty option expiry interest in the cross residing down at 1.0860 (1.87 bn).

- CAD/NOK/NZD/CHF – The other major laggards, as the Loonie and Norwegian Krona trade softer with oil sub-1.3100 vs the Greenback and circa 10.6100 against the Euro respectively, with the latter also taking on board softer than forecast monthly mainland GDP. Meanwhile, the Kiwi retreats from 0.6700+ and Franc pivots 0.9170/1.0830 ahead of NZ manufacturing sales later tonight and Swiss jobs tomorrow.

- EUR/JPY/SEK – The Euro is straddling 1.1800 vs the Buck and largely treading water in advance of Thursday’s ECB policy meeting, while the Yen is even more constrained below 106.00 following minor Japanese GDP revisions and the Swedish Crown seems to be gleaning a degree of underlying support from ip as Eur/Sek meanders either side of 10.3700.

- EM – The Try’s slide will grab headlines as it slumps to fresh record depths nearer the psychological 7.5000 mark, but other regional currencies are also depreciating, like the Rub on the back of Brent weakness and the Zar after a bigger than expected Q2 GDP contraction (SA economy shrank 50%+ in q/q annualised terms).

In commodities, WTI and Brent front month futures are on a downwards trajectory in what seems to be a sentiment driven move as it coincided with losses in stocks markets and the fixed income bid. UAE’s ADNOC moved in lockstep with Saudi Aramco in lowering their flagship crude grade in a sign that demand is faltering. On this front, easyJet has cut its flights amid the UK government announcing more quarantine measures – a sign of reduced demand for travel and fears that have been flagged by the IEA MOMR last month. Furthermore, crude imports from China have continued to ebb lower from June’s record levels (11.23mln BPD in August vs. 12.13mln BPD in July vs. 12.99mln BPD in June). Meanwhile, Russian Energy Minister Novak also remarked that it is important Russian production, alongside other oil producers, returns quickly or even undertakes an increase in market share upon the oil demand recovery – comments that come ahead of this month’s JMMC meeting. WTI sees more pronounced losses than its Brent counterpart on account of no settlement for the former yesterday given the Labor Day holiday. WTI October resides just under USD 38.50/bbl whilst Brent November lost its USD 41.50+/bbl status (vs. high USD 42.23/bbl). Elsewhere, spot gold and silver move in tandem with the Dollar as the index sees somewhat of a revival from early EU hours. The yellow metal trades closer to session lows around USD 1923/oz whilst spot silver gave up its USD 27/oz handle. Finally, LME copper prices have eased due to the downbeat sentiment coupled with a firmer Buck.

Top European News

- Merkel Ready to Link Nord Stream With Russian Navalny Response

- EU Makes Latvia’s Dombrovskis Trade Chief to Deal With U.S.

- Commerzbank Board Rebukes Retail Head for Turnaround Failure

- Irish PM Warns Johnson Over Backsliding From Brexit Divorce Deal

DB’s Jim Reid concludes the overnight wrap

Receive a daily recap featuring a curated list of must-read stories.

So after three days cooling off, the US market reopens today after last week’s late and so far brief tech rout. At the lows on Friday the Nasdaq was down c.10% in just over 24 hours. It did stabilise and recover soon after the Friday open but this will be the first full trading session where specific news of the recent fevered options market activity has been fully revealed to the market. So it’s a big session today. Futures on the S&P 500 and Nasdaq are +0.25% and -0.57% respectively.

Overnight in Asia markets are mostly firm outside of China/HK with the Nikkei (+0.51%), Kospi (+0.67%) and Asx (+0.80%) all up while the Hang Seng (-0.57%) and Shanghai Comp (-0.34%) are down. Its seems like the latter two are underperforming on yesterday’s news that President Trump is intending to decouple the US economic relationship with China as he threatened to punish any American companies that creates jobs overseas and to forbid those that do business in China from winning federal contracts. He added, “Whether it’s decoupling or putting massive tariffs on China, which I’ve been doing already, we’re going to end our reliance on China because we can’t rely on China ”. In FX, the US dollar index is up +0.45% this morning. Yields on 10y USTs are trading down -1.2bps while WTI crude oil price are down -1.9% to $39.02. In terms of overnight data releases Japan’s final Q2 GDP was confirmed at -7.9% qoq, a touch better than consensus of -8.0% yoy while July household spending came in at -7.6% yoy (vs. -3.7% yoy expected).

In other overnight news, the BoE Chief Economist Andy Haldane warned against extending the UK government’s flagship coronavirus furlough program as he said that “Keeping all those jobs on life support is in some ways prolonging the inevitable in a way that actually doesn’t help either the individual or the business.” He added that the UK firms should look to wage restraint or reduced hours as a “less painful way of adapting” than job cuts. Meanwhile, on the economy, he had a bit better view than his colleagues as he said that “Right now the prevailing narrative is a bit gloomier than I think is justified by the data.”

With the US out on holiday yesterday for Labor Day, European equities shrugged off the selloff in risk assets at the end of last week to make solid advances. By the close, the STOXX 600 had climbed +1.67% with every sector moving higher on the day, while the DAX (+2.01%), the CAC 40 (+1.79%) and the FTSE 100 (+2.39%) also saw notable gains. These solid advances came in spite of continued negative news on the coronavirus in Europe, as signs of a rise in cases continued to accumulate as we head towards the winter months. Here in the UK, a further 2,951 cases were reported yesterday, which sent the 7-day average to its highest level in over 3 months. Overnight, the UK government has imposed a 14-day quarantine requirement for travellers arriving from seven Greek islands, thereby taking a regional approach for the first time. Meanwhile in Denmark, restrictions were reintroduced yesterday, with public gatherings now limited to 50, having been 100 before. Across, the other side of world, as new cases in Japan have started to come down, Kyodo has reported this morning that the Japanese government is considering eliminating the cap of 5,000 people it has on event sizes as soon as September 19. Hong Kong’s government is also planning to further ease virus-related restrictions and allow restaurants to seat four people per table instead of the current limit of two.

Amidst the recent rise in cases, a common pattern across multiple countries is that younger people are increasingly contracting the virus. We looked at this in our Chart of the Day yesterday (link here) which showed how the age composition of cases has changed over time. There is an element of increased testing but I still think the trend is valid. At the first peak of the virus in late March (using data from England), 61% of the confirmed cases were among those over 60, while just 12% came from the 20-39 age group. On the latest data however, the over-60s make up just 11% of cases, while the 20-39 group are now at 48%. So a big transition that goes some way to explaining why hospitalisations and deaths have remained subdued relative to the first wave, even as cases have started to rise again.

In foreign exchange markets, sterling slumped against other major currencies yesterday as the spectre of a no-deal Brexit returned to markets following the FT’s report that the UK could seek to undermine parts of the Withdrawal Agreement. In terms of the details, the report said that the UK government’s new internal market bill – which is scheduled for publication tomorrow – will override parts of the Brexit Withdrawal Agreement reached last year, specifically the Northern Ireland protocol that is designed to avoid a hard border between Northern Ireland and the Republic of Ireland. This is potentially very problematic for the ongoing trade negotiations between the two sides, since the Withdrawal Agreement is an international treaty between the UK and the EU that came into force at the end of January, having been signed by Prime Minister Johnson and passed by both houses of the UK Parliament.

On the UK side, a spokesman for Prime Minister Johnson said to reporters that “we are fully committed to implementing the Withdrawal Agreement and the Northern Ireland Protocol”, and said that these steps were “minor clarifications in extremely specific areas”, in order to avoid legal confusion. However, the news was not met so positively on the EU side, with Irish foreign minister Coveney tweeting that “This would be a very unwise way to proceed”. Even Commission President von der Leyen weighed in, tweeting that “I trust the British government to implement the Withdrawal Agreement, an obligation under international law & a prerequisite for any future partnership”.

Concerningly for markets however, the reports on the internal market bill come against the backdrop of a broader increase in tensions between the two sides. Over the weekend, the UK’s chief negotiator David Frost gave an interview to the Mail on Sunday, in which he said that the UK was “not going to be a client state. We are not going to compromise on the fundamentals of having control over our own laws.” Meanwhile Prime Minister Johnson said yesterday that there needed to be an agreement by October 15, and that if an agreement weren’t reached by that point, “then I do not see that there will be a free trade agreement between us, and we should both accept that and move on.” So a clear escalation in rhetoric, which was reflected in FX markets as sterling fell by -0.85% against the US dollar (a further -0.14% this morning), being the worst-performer in the G10 yesterday. We should get some more headlines on this later in the week, since the 8th round of negotiations starts today between the two sides, and is due to wrap up this Thursday.

In terms of other markets yesterday, sovereign bonds lost ground somewhat as investors moved into riskier assets. 10yr yields on bunds (+1.1bps), OATs (+1.0bps) and BTPs (+3.0bps) all moved higher. Oil saw declines too, with Brent crude falling to a 2-month low as it fell a further -1.52%. Finally, there was little data to speak of with the US on holiday, but we did get German industrial production for July, which rose for a 3rd consecutive month, but by a less-than-expected +1.2% (vs. +4.5% expected).

To the day ahead now, and as mentioned the 8th round of negotiations kicks off between the UK and the EU on their future relationship. There isn’t a great deal of data, though we will get the German and French trade balances for July, along with Italian retail sales for that month. In the US, we’ll also get the NFIB small business optimism index for August, and July’s consumer credit.

Source: zerohedge.com

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()