You Have More Duration than You Think

2020 has seen a pandemic inflict enormous human and economic cost. In 2Q, the global economy contracted by the largest amount on record and, as autumn approaches, major questions around returning to school, work and other aspects of daily life remain.

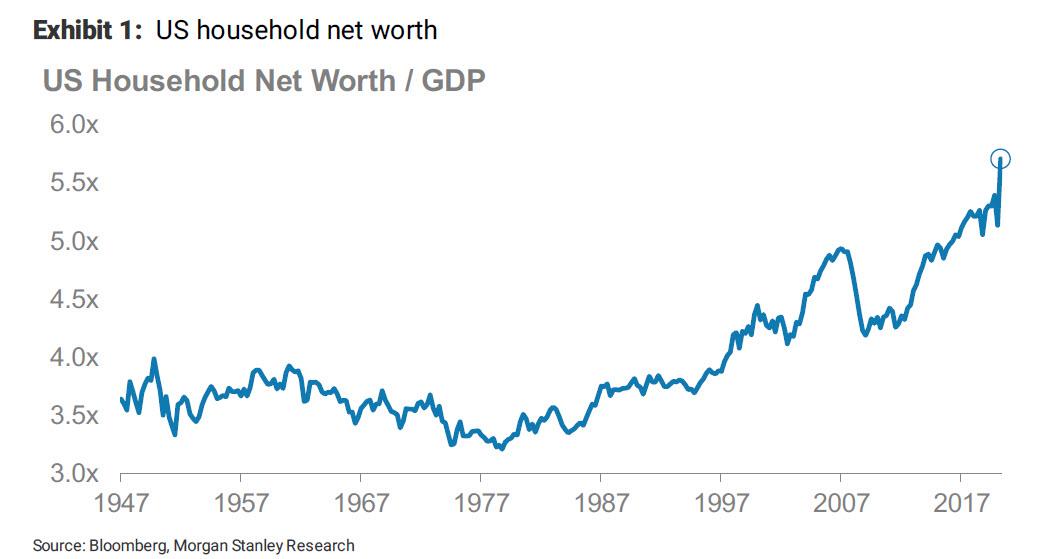

But for investors, 2020 has been something different. Year-to-date, the value of the global equity market is broadly unchanged. The value of the global bond market is significantly higher. Home prices in many markets have risen. Indeed, an uncomfortable aspect of 2020 is that this terrible year has generally meant gains for asset owners. US household wealth/GDP has made a new record high.

Many factors are behind this. The global economy is improving, in line with the V-shaped recovery thesis of Morgan Stanley’s economists. Initial progress on a vaccine has been promising, lowering the probability of a larger, more permanent shock. And both fiscal and monetary policy have been aggressive, with trillions spent and bought in an attempt of offset the impact of COVID-19.

But another driver has been a classic case of ‘having your cake and eating it’: global bond yields have remained near historical lows, even as global PMIs have moved back above 50. This matters: global investors have historically high exposure to duration.

Let’s start with fixed income. First, the total amount of bonds owned by investors has grown. Using the Bloomberg Global Agg as a proxy, the market value of the global bond market has risen 27% in just the past two years. Not only are there more bonds, but these bonds are longer in duration. Over the same two-year period, the duration of the global bond market has increased by ~5%, to a record high, as both corporates and governments have taken advantage of low yields to extend maturity. And this is with extremely high mortgage prepayment speeds; if those slow, global duration would increase further.

Since every bond is owned by someone, a larger, longer-duration market has meant strong returns from doing nothing more than holding the index. But this isn’t just a story about bonds. It applies to equities too.

Year-to-date, consumer discretionary stocks (of which Amazon is by far the largest component) have had the highest correlation to US real rates (real yields lower, stocks up), with the technology sector close behind. What do both sectors also have in common? They’re getting larger.

At the start of 2019, these two sectors represented 24% of the global equity market. Today, it’s 30%. Globally, investors hold US$8.1 trillion more of these yield-sensitive sectors than they did just ~18 months ago. This isn’t just a US phenomenon; as my colleague Jonathan Garner has noted, EM equities have also become much more tech-heavy in recent years.

And that’s assuming one follows the benchmark. Our data suggest that these two sectors are popular and well-owned. Even if most investors are buying these stocks for their business models, rather than their rate sensitivity, the attribute remains.

As yields have fallen and uncertainty abounds, investors have looked elsewhere for diversification. They have flocked to precious metals as ‘new diversifiers’, but here too yield sensitivity looms. Rather than being a ‘hedge’, gold and silver may simply be another expression of the real rate exposure one already has.

With the Fed suggesting that it will shift its framework to be more dovish in the face of inflation, and recent data surprising to the upside, it’s possible that the extreme levels of real rates persist for a little while longer. Indeed, my colleague Guneet Dhingra sees value in US 5yr TIPS, and expects real rates to fall further in the near term.

Receive a daily recap featuring a curated list of must-read stories.

But it’s important to take stock of just how much serendipity has been at work. From a growing bond market that’s been extending in duration, to a global equity market where lower real yield winners have gained share, investors have become more exposed to rates even if they’ve taken no active action. This sensitivity is occurring at the richest levels for these yields ever recorded. This is one reason why my US colleagues have downgraded software from overweight – a sector with very high valuations and interest rate sensitivity. With duration exposure surfacing across portfolios, we like owning interest rate volatility (while we prefer to sell equity volatility). And for central banks, this dynamic should highlight the dangers of overcooking markets that are already doing quite well.

To be clear, we think that overall equity and credit markets can weather a modest rise in yields, driven by better data. Risk assets have frequently been happy to trade a better growth outlook for a higher discount rate, and we saw this pattern as recently as Monday when global PMIs surprised to the upside. But the rise in duration across asset classes, at its most expensive levels on record, suggests that the transition won’t be smooth. Whether one is active or passive, August is a good time to evaluate, and be honest about, your cross-asset duration exposure. Source

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()