For all these reasons, the risks of systemic collapse are much higher than commonly anticipated.

There’s an irony in discussing risk: since we all have an instinctive reaction to visible risk, we think we understand it. But alas, we don’t, especially when the risk is invisible and systemic.

We even misjudge extremely visible risk. People routinely die rushing to save someone who foolishly waded into fast-moving water a few yards above a waterfall. The rescue is clearly suicidal and doomed but they try anyway, doubling the tragedy by losing their own life.

We’re prone to ignore risks that we’ve taken and gotten away with before: boat’s overloaded and seas are rising? Hey, we’ve done this a hundred times and nothing bad ever happened.

We overestimate our level of control. Don’t worry, I got this… crash.

And we overestimate our risk management skills, confident that the situation won’t get away from us.

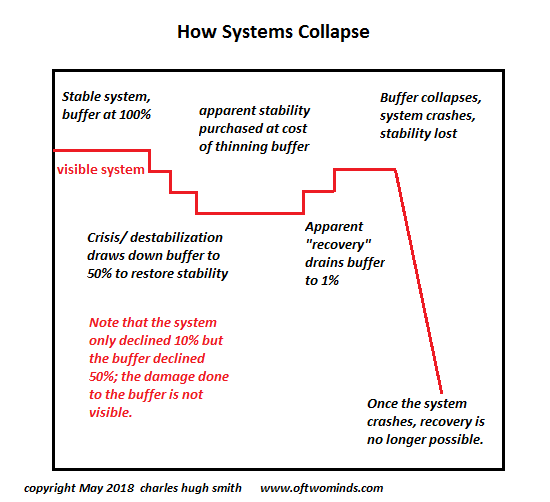

Systemic risk is difficult to isolate and analyze, so we’re literally blind to it. It’s not that we’re blithely ignoring risk–we simply do not see it. We’re flying blind through jagged mountain tops we can’t see through the thick fog of false confidence.

There are several reasons for our innate difficulty in discerning risk. One I covered last year in Crunchtime: When Events Outrun Plan B (December 4, 2019) is recency bias: the natural assumption that the recent past is a reliable guide to the future. This leads us to underestimate the risk of non-linear financial-economic dynamics.

Linear means increasing or decreasing inputs to the system generate equivalent outputs: doubling the input doubles the output, and so on. Non-linear means modest changes in inputs generate outsized changes in outputs.

It’s not easy to discern the potential for non-linear dynamics until they emerge, typically with surprising speed. This is why stock market crashes catch the vast majority of punters off-guard.

Central banks and governments have gone to extreme lengths to maintain the illusion of linearity, but these extreme measures have generated emergent properties beyond their control. This illusion of linearity implies a control of dynamics so perfect that no linear situation can ever become non-linear. This is the illusion of godlike control.

In other words, we assume the authorities (The Federal Reserve, etc.) have godlike control which limits the risk of things spiraling out of control (i.e. non-linearity)

Another reason we’re blind to risk is we naively assume risks add up like a grocery bill. Take a 5% of something bad happening, add another 5% risk and a third 5% risk, and the total risk we face is only 15%–hey, that’s not much.

The problem is independent-variable risks don’t add up, they compound. As correspondent A.P. explained to me recently: risks are independent variables with cumulative effects that are compounded, not additive. So the three variables, each with a 5% risk factor, pose a compounded risk far higher than 15%.

In other words, we may view each risk factor as low and feel a false sense of safety because we failed to compound all the individually “low-risk” factors into a composite of risk, which could compound into a very high probability of something unexpectedly bad happening.

Then there’s feedback, a dynamic I’ve discussed many times, most recently in How Extremes Become More Extreme, Triggering Collapse (August 28, 2020)

Somewhat counter-intuitively, when feedback arises to moderate the intensity of a trend, that’s negative feedback. When feedback intensifies the trend, it’s positive feedback.

Why is this counter-intuitive? If a bad trend is moderated by negative feedback, that’s good (positive). If a bad trend gathers momentum due to positive feedback, that’s bad (negative).

When an insect population explodes higher due to ideal conditions, birds and other predators feast on the over-supply, reducing the infestation. This negative feedback moderates the damage inflicted by the infestation.

If a rapidly expanding insect horde has few predators and its range and mobility increase with every generation, allowing it to find new food sources, this positive feedback enables a vast expansion in each generation–exactly what’s we’re witnessing with locusts.

Positive feedback leads to runaway systems, i.e. run to failure where the trend accelerates until the system collapses.

If the system is isolated, then the damage might be contained. But if the system is interconnected with others, then its failure could trigger the collapse of other systems, either as a direct (first-order) effect or as an indirect (second-order) effect.

In other words, in highly inter-connected systems, one failure can trigger a domino effect that can become non-linear once second-order effects manifest.

All of these dynamics are in play in America’s healthcare system, which I discussed rcently in How Systems Collapse: Reaping What We’ve Sown and Everything We Assume Is Permanent Is Actually Fragile (October 23, 2020).

Here’s an example: the CDC reported that 1 in 16 health care personnel (HCP) contract Covid and require hospitalization. If the healthcare worker is older than 60 and/or has an underlying condition, the risks are much higher. At some point, these compounding risks will influence decisions.

Hospital administrators fearing wrongful-death lawsuits from over-60 staffers who contract the virus and die from complications may fire older staffers to limit their legal liability.

Individual healthcare workers who are responsible for caring for elderly parents or children at home may conclude the risk of contracting Covid at work and suffering Long Covid debilitation outweighs the income from their job, and seek alternative employment with lower exposure to Covid patients.

The greater one’s responsibility for physical care of dependents at home, the more devastating the impact of Covid hospitalization or long-term debilitation, and so at some point the risks of continuous exposure to Covid-infected patients are simply not worth it.

Given the prevalence of organ damage (heart, liver, etc.) even in asymptomatic carriers of Covid, older healthcare workers may conclude it’s not worth the risks of permanent organ damage to continue exposure to Covid-infected patients, and so they may choose to retire early.

Compound these decisions, add in feedback of rising hospitalizations and there’s a rising risk of the illusion of linearity giving way to explosive non-linear run-to-failure. Just because it hasn’t happened yet doesn’t mean it can’t happen.

Lastly, the risks of drawing grandiose conclusions from limited data are largely invisible, too. This is one of the risks in the rushed vaccine trials currently underway. Please read Covid-19 Vaccine Protocols Reveal That Trials Are Designed To Succeed (Forbes.com) by William A. Haseltine before assuming the vaccine trials are accurate estimations of risks.

“One of the more immediate questions a trial needs to answer is whether a vaccine prevents infection. If someone takes this vaccine, are they far less likely to become infected with the virus? These trials all clearly focus on eliminating symptoms of Covid-19, and not infections themselves. Asymptomatic infection is listed as a secondary objective in these trials when they should be of critical importance.

It appears that all the pharmaceutical companies assume that the vaccine will never prevent infection. Their criteria for approval is the difference in symptoms between an infected control group and an infected vaccine group. They do not measure the difference between infection and noninfection as a primary motivation.

A greater concern for the millions of older people and those with preexisting conditions is whether these trials test the vaccine’s ability to prevent severe illness and death. Again we find that severe illness and death are only secondary objectives in these trials. None list the prevention of death and hospitalization as a critically important barrier.”

For all the reasons listed in this post, the risks of systemic collapse are much higher than commonly anticipated. Recency bias, belief in the illusion of linearity and the godlike powers of authorities, failure to properly compound risk variables and feedback, uncritical acceptance of limited data–any one of these is the equivalent of flying blind, without radar, through thick fog.

Compounding all these factors is the equivalent of flying through thick fog at 5,000 feet straight toward the Rocky Mountains.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook coming soon) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF).

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()