previewed on Friday and again earlier today when we noted the latest trades in China’s A50 futures…

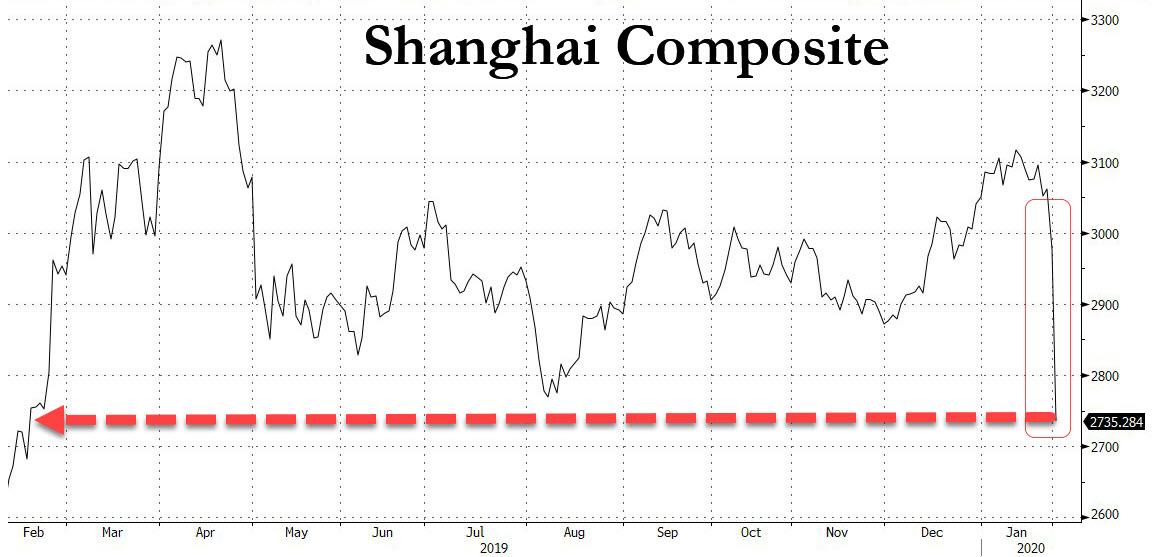

… China’s reopening from the long Lunar New Year holiday was set to be ugly, and sure enough with Chinese stocks resuming trade at 9am on Monday, a wave of selling was unleashed culminating in nothing short of a bloodbath with the Shanghai Composite crashing 9% at the open, down by the most since the bursting of China’s 2015 stock bubble, and wiping out 12 months worth of gains in a corona moment.

Not even the hilarious beat in China’s Manufacturing PMI (this time from Caixin), which somehow surpased expectations of a 51.0 print by the smallest amount possible at 51.1 (down from 51.5) despite a major portion of China’s population under quarantine and the economy hitting a brick wall, had any impact on stocks.

What is odd is that this is happening even as China earlier in the day barred short selling, which only means the central bank made a huge oversight and should have also banned all selling altogether.

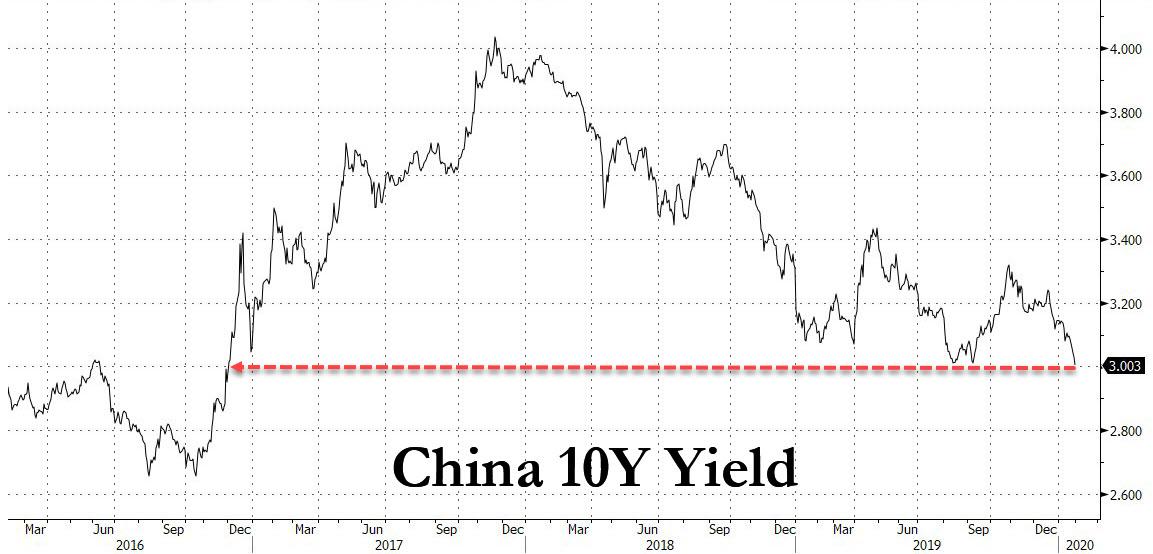

As stocks collapse the flight to safety is predictably on with 10Y Chinese bond tumbling in yield to 3%, matching the lowest yield since late 2016…

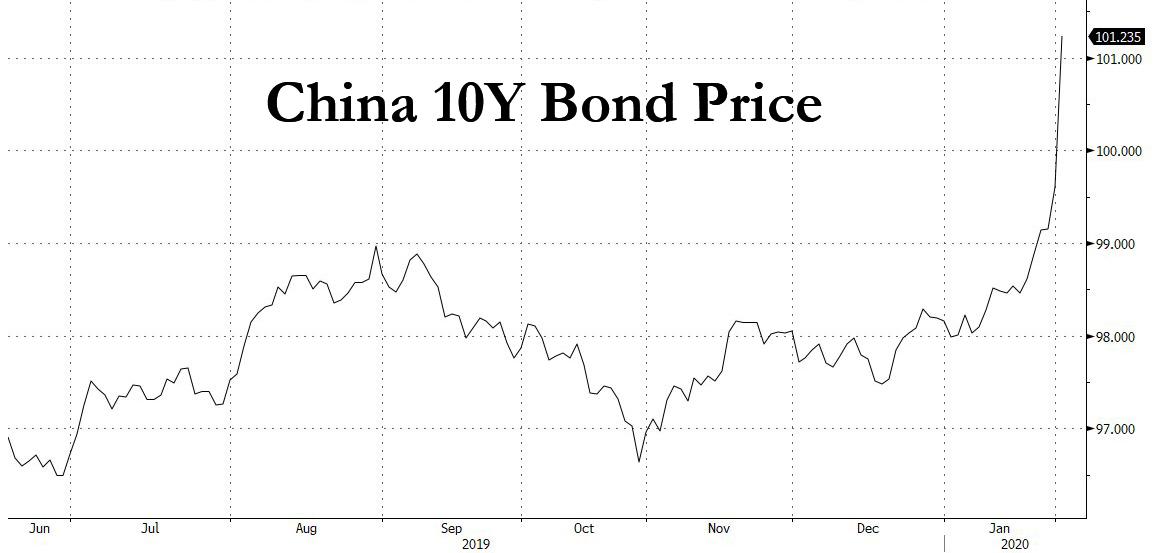

… while spiking in price.

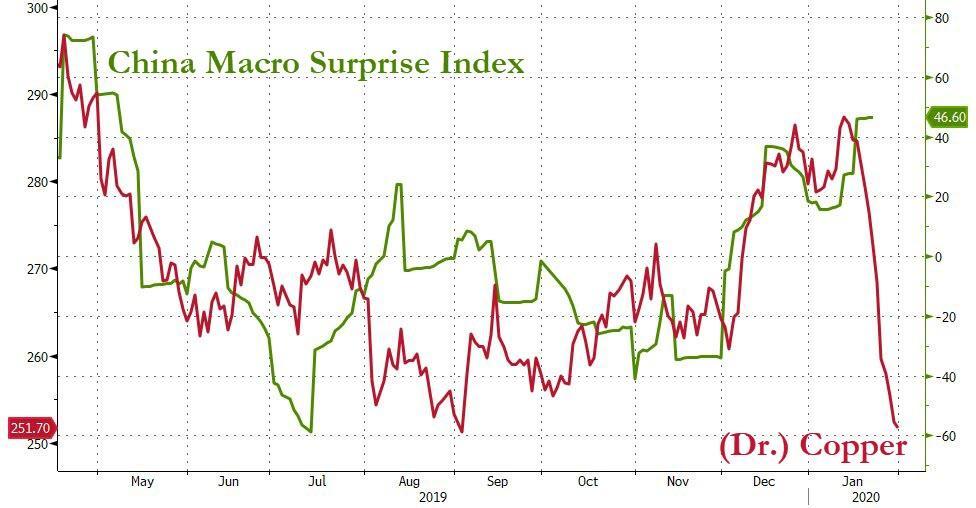

The selloff wasn’t limited just to stocks, however, with China’s benchmark iron ore contract falling by its daily limit of 8%, with copper, crude and palm oil also plunging by the maximum allowed. As Bloomberg notes, regions accounting for about 90% of copper smelting, 60% of steel production, 65% of oil refining and 40% of coal output have told firms to delay restarting operations until at least Feb. 10.

This is bad news for anyone still holding on to dreams of a Chinese economic renaissance, as the following correlation between China’s macro surprise index and copper demonstrates.

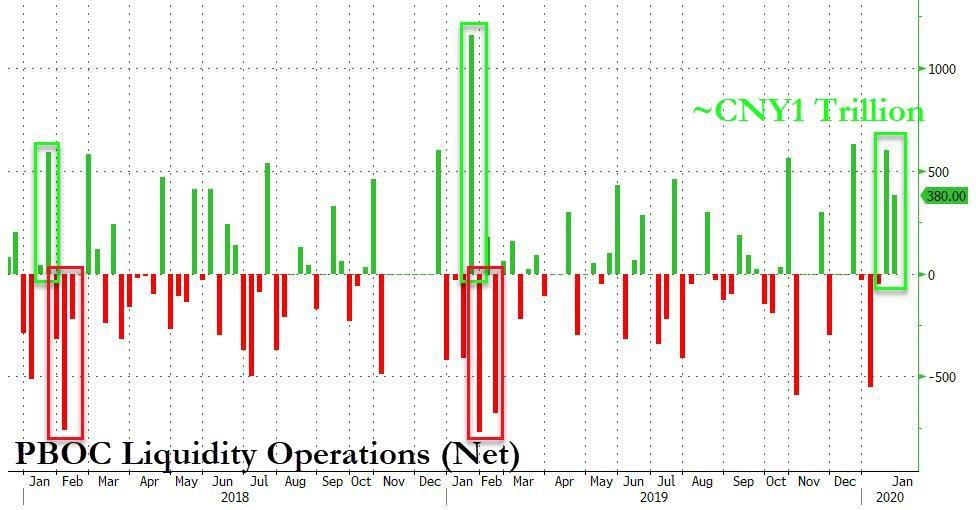

China’s bloodbath is taking place even as the PBOC scrambled earlier in the day to inject a gross 1.2 trillion in liquidity which however as we explained, was woefully inadequate because when netting off the 1 trillion in short-term reverse repo funds scheduled to mature on Monday, the liquidity injection amounted to a far more modest 150BN yuan, or just over $27BN.

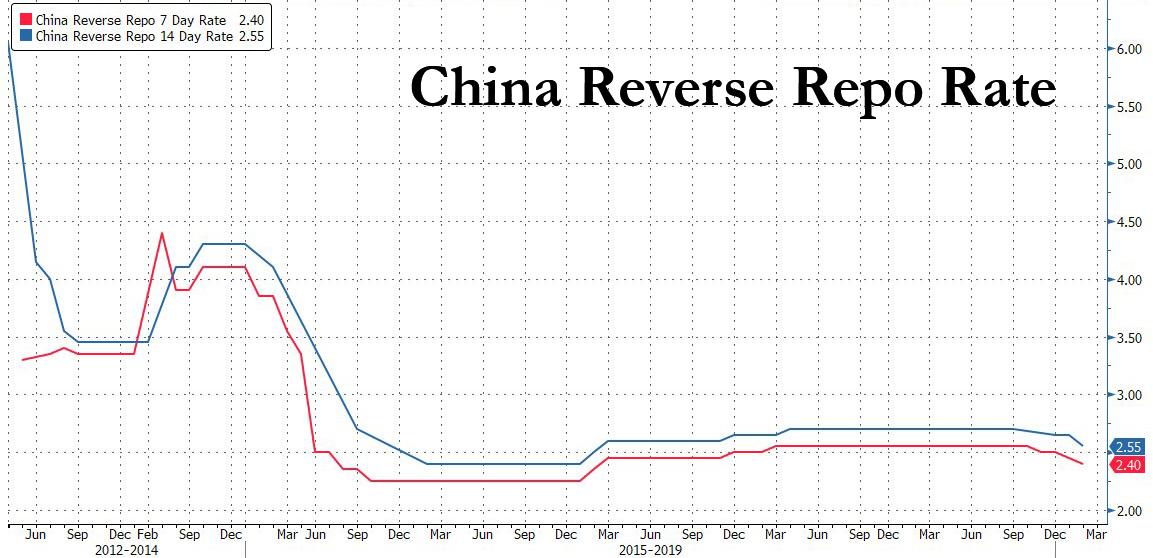

The lack of any notable impact from China’s reverse repo injection probably explains why shortly after the catastrophic open, the PBOC also cut rates on both its 7 day and 14 day-reverse repo from 2.5% to 2.4%, and from 2.65% to 2.55% respectively.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

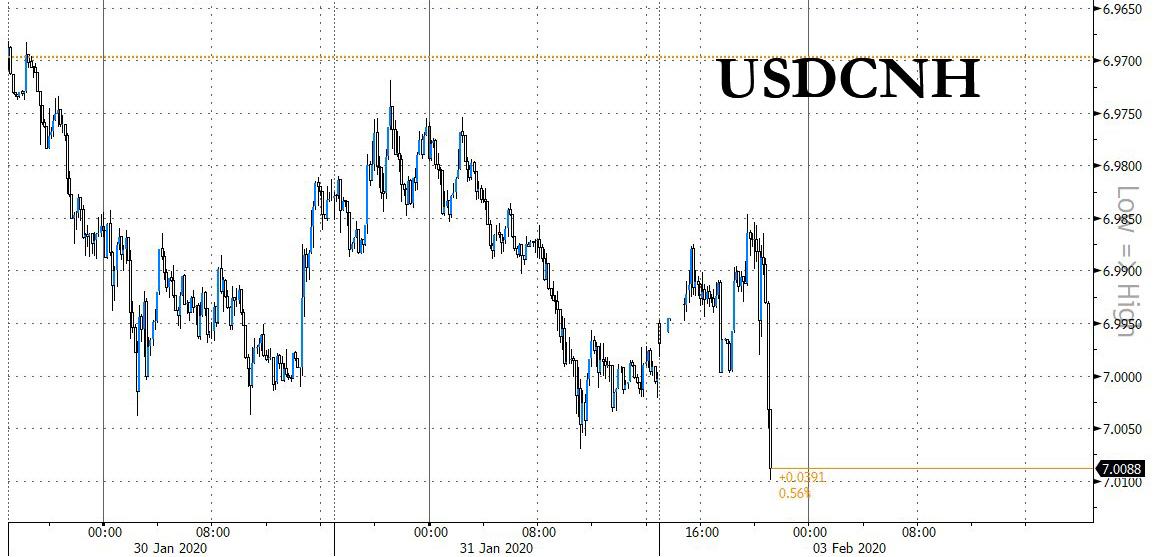

Then, as a result of the unexpected additional easing, the Yuan promptly slumped back under 7.00, potentially risking the framework of the US-China trade deal, and the reversal in the US Treasury’s designation of China as a currency manipulator.

Then again, in retrospect it’s probably not accurate to say China’s emergency intervention and rate cut has had no positive impact on stocks: after all US futures have surged since the open and are up 0.7%, or 21 points, to 3,245 from Friday’s 3,223 close.

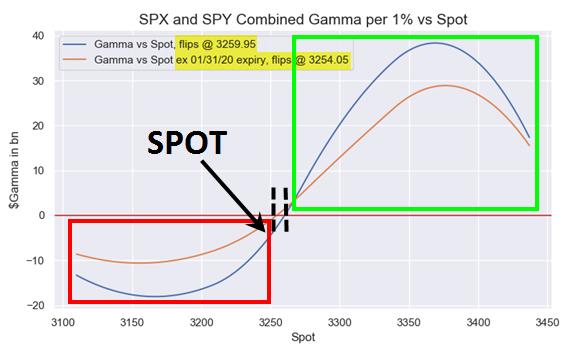

As a reminder, 3,250 is the critical gamma “flip” level which has to be sustained at all costs…

… or else any additional selling will only beget even more selling, which is certainly on the mind of whoever is buying the US fits even as China is crashing. Source: ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

Tagged Under: Fraud,Banks,Money,Corruption,Bankers

![]()