Liquidation: Stocks, Bonds, Bullion, & Bitcoin All Puked

Well that really did escalate quickly… Today had the feeling of ‘liquidation’ (similar to March) as big-tech stocks (growth/value rotation), bitcoin,…

![]()

Day-Traders Send US Producer Prices Soaring In July

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising…

![]()

Nasdaq Tumbles Into Red, Erases Vaccine Spike As ‘Memo Meltdown’ Continues

All major US equity indices spiked in the early hours overnight on the back of optimistic vaccine headlines from Russia….

![]()

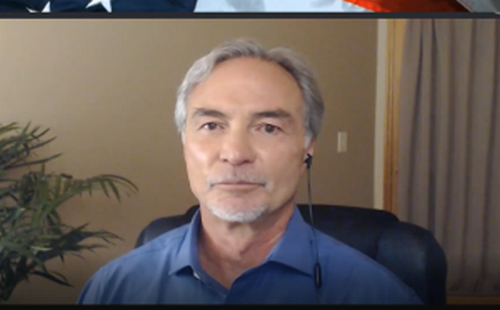

“World On Verge Of Spinning Out Of Control”

Financial writer John Rubino says gold is at new all-time highs, silver is vaulting upward and there is no end…

![]()

It’s Happening Again… Investors Dump Everything ‘China’

Global stock markets plunged Friday as tensions between the US and China spiral out of control. Stocks in Hong Kong and mainland China…

![]()

How Deutsche Bank Helped Con The Public Into Believing In Wirecard

By Tyler Durden More reporting on the Wirecard situation has emerged over the long weekend in the US, and none of it…

![]()

Who Is The Next Wirecard?

Now that the multi-year saga of German fintech megafraud Wirecard is finally over, the pain is only just starting for…

![]()

BoE Warns Of Worst Economic Slump In 300 Years

The Bank of England’s Monetary Policy Committee (MPC) “voted unanimously” to keep the banking rate at 0.1% and left its bond-buying program unchanged despite…

![]()

Front-Month WTI Crude Crashes Below Zero For First Time Ever

Over the last several decades, have we ever seen a year start as strangely as 2020 has? Global weather patterns…

![]()