Flying Blind: Clueless About Risk, We’re Speeding Toward Systemic Failure

For all these reasons, the risks of systemic collapse are much higher than commonly anticipated. There’s an irony in discussing risk: since…

![]()

World’s Top Oil Trader Is Now A Used Car Salesman

Vitol Group, the world’s largest independent oil-trading firm, has been startled by the prospects of peak oil demand as it…

![]()

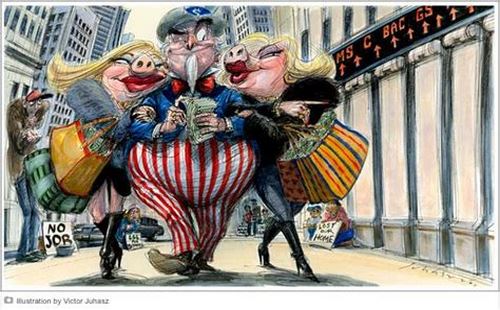

Financialization & The Road To Zero, Part 1: The Evolution Of Commerce

This is Part 1 of a 4-part series. fi·nan·cial·i·za·tion /fəˌnanCHələˈzāSHən, fīˌnanCHələˈzāSHən/ noun The process by which financial institutions, markets et…

![]()

The Fed’s Big Lie

Insanity is doing the same thing over and over again, but expecting different results. Federal Reserve Chairman Jerome Powell announced…

![]()

In The Long Run… We Are All Alive

In 1976, economist Herbert Stein, father of Ben Stein, the economics professor in Ferris Bueller’s Day Off, observed that U.S….

![]()

America’s Coming Double Dip

www.zerohedge.com Soaring financial markets are blithely indifferent to lingering vulnerabilities in the US economy. But the impact of consumers’ fear of…

![]()

What Are You Going To Do As Our Money Dies?

Central banks are killing our currency to protect the already-rich… In our recent article It’s Time To Position For The Endgame,…

![]()

“Stand Down!” – How One Navy Seal Killed A Multi-Billion Hedge Fund

It has now been revealed that the fall of Dan Kamensky’s Marble Ridge Capital was at the hands of a former…

![]()

World’s Biggest Sovereign Wealth Fund Lost $21 Billion In First Half 2020

Readers may recall in April that Norway’s sovereign wealth fund, the world’s biggest, posted record losses for 1Q20 as the virus pandemic wreaked havoc on global markets. …

![]()

S&P Jumps Above Record High After $9 Trillion Global Liquidity Tsunami

$9 trillion in additional global liquidity (from $79 to almost $88 trillion since the March lows)… Are we Drowning in…

![]()