Will Modern Monetary Theory Blow Up The Dollar?

“As long as the government can print money, we’ll never be broke.” That’s the idea behind modern monetary theory (MMT)…

![]()

It’s D-Day For The Repo Market: On Monday $100 Billion In Liquidity Will Be Drained – What Happens Next?

Last week’s apocalyptic report by repo market guru Zoltan Pozsar, which for those who missed it predicted that an imminent market crash…

![]()

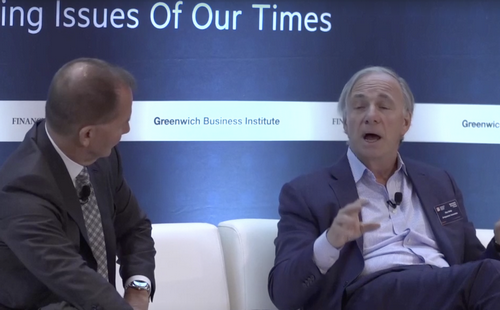

Dalio & Tudor Jones Warn: “We Will Kill Each Other” If Our Broken Economic System Isn’t Fixed

Two hedge fund icons – Bridgewater founder Ray Dalio and Paul Tudor Jones – joined Yahoo Finance for the 2nd annual Greenwich…

![]()

Its BS, Fracking Blows Up Investors Again: Phase 2 Of The Great American Shale Oil & Gas Bust

In 2019 through the third quarter, 32 oil and gas drillers have filed for bankruptcy, according to Haynes and Boone. Since…

![]()

Snyder: “Brace For Impact!” The US Economy Is Going Down, And It’s Going Down Hard…

I have so many bad economic numbers to share with you that I don’t even know where to start. I had…

![]()

The Federal Reserve Works for the Foreign Bank$Ters [Central Banks]…

as the Principal Creditors in the Receivership of the USA Bankruptcy. The Bankster’s hate bad press (lucky for them they…

![]()

German Finance Minister Publishes New Banking Union Plan To Save The EU (And Deutsche Bank)

Less than a year after his finance ministry failed to broker a merger between Commerzbank and Deutsche Bank in a…

![]()

The 3 Things Behind Mass Social Unrest In Bolivia, Hong Kong, France, Spain, Iraq, Lebanon, Egypt, And Elsewhere

Social unrest seems to be cropping up all over the world, from Hong Kong to Bolivia and Lebanon; we offer up…

![]()

Chinese Bank On Verge Of Collapse After Sudden Bank Run

Coming to America SOON, when dealing with a collapsing Ponzi scheme, only those who pull their money first stand to…

![]()

U.S. Shale Braces For Brutal Earnings Season

A lot of big names will report third-quarter earnings this week, and the results are expected to be worse than the…

![]()