by Tyler Durden

A quiet macro day (though we did see NYFRB inflation expectations plunge!), but some ‘good’ news from Washington reduced the risk of govt shutdown in 11 days modestly.

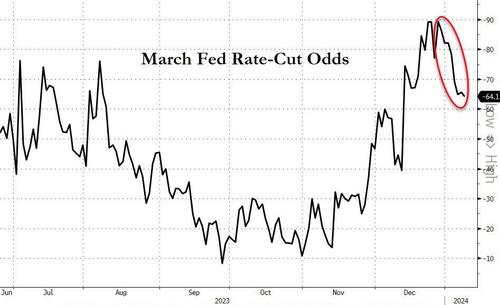

However, there was plenty of new narrative creation from FedSpeak. Logan and Bostic double-whammy’d with ‘not as dovish as the market thinks’ comments on rates BUT ‘more dovish than the market thinks’ on Fed balance sheet runoff…

- *LOGAN: FED SHOULDN’T DISCOUNT POSSIBILITY OF ANOTHER RATE HIKE

- *LOGAN: IF FINANCIAL CONDITIONS LOOSEN, INFLATION RISKS A PICKUP

- *LOGAN: FED SHOULD BEGIN DISCUSSION ON SLOWING ITS ASSET RUNOFF

- *BOSTIC: FED CAN LET RESTRICTIVE MONETARY POLICY PROCEED

- *BOSTIC: EXPECTS FIRST RATE CUT IN THIRD QUARTER

- *BOSTIC: OPEN QUESTION ON WHETHER ASSET RUNOFF PACE SHOULD CHANGE

This prompted March rate-cut odds to decline a little more…

Source: Bloomberg

But sent Swap-spreads significantly higher, a warning sign from the market on potential liquidity issues ahead…

Source: Bloomberg

Treasury yields were lower across the curve with the belly outperforming. The bulk of the buying took place in the European session…

Source: Bloomberg

The 10Y yield broke back below 4.00% intraday (though held above Friday’s lows), but ended above 4.00%…

Source: Bloomberg

Negative gamma (meaning moves are exaggerated one way or the other) combined with lower yields and dovish Fed comments sent stocks soaring, led by mega-cap tech (laggards to leaders) and small caps (short-squeeze-fest). The Dow lagged thanks to Boeing’s bloodbathery…

0-DTE traders bought calls with both hands and feet with massive positive delta flow all day and a late-day spike at the close…

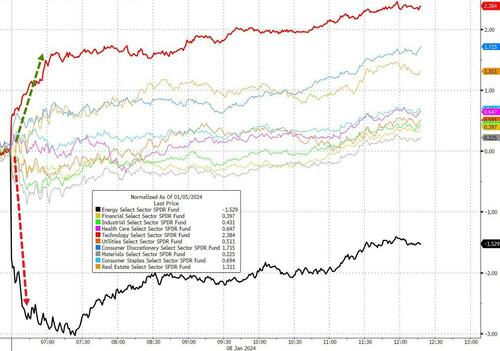

Tech (and Discretionary) sectors outperformed today while the only red sector was Energy which was hammered as crude crumbled…

Source: Bloomberg

‘Magnificent 7’ stocks soared higher today, erasing 75% of the losses for the year…

Source: Bloomberg

‘Most Shorted’ stocks squeezed hard today, erasing around half of the YTD losses to Friday’s close…

Source: Bloomberg

Retail favorite (meme stocks) rallied hard today…

Source: Bloomberg

The dollar limped lower on the day but held above Friday’s whiplash lows…

Source: Bloomberg

Bitcoin exploded higher today amid growing anticipation of the SEC’s imminent approval of a spot ETF…

Source: Bloomberg

That sent the largest cryptocurrency to its highest since March 2022 – before all the existential crisis (TerraUSD, FTX, 3AC etc) struck…

Source: Bloomberg

And Ethereum underperformed, now at its weakest since April 2021…

Source: Bloomberg

Despite the dollar weakness – and Fed dovishness – spot gold prices declined, but found support at $2020, near the top of the FOMC-day spike…

Source: Bloomberg

But the big news was in black gold as WTI crashed to a $70 handle…

Finally, the ‘good’ news for Biden is that the lower oil prices have pulled the price of Regular Gasoline at the pump to its lowest since May 2021…

Source: Bloomberg

…but that’s still 37% higher than when Biden came into office.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

![]()