Force is now the only rule remaining in deep state-controlled America. Everything has collapsed, no free speech, no fair trial, no system of justice, no reasonable expectation of human rights anywhere, no fair elections, no trustworthy news, no legitimate Wall Street operations, no real public education, no clean food, and threats from the elitist.

The power structure that is hell-bent on bringing the New World Order into the reality of the sleeping masses get woke or get yoked, and the choice still lives in the people’s hands. Next, the AntiChrist will appear with many empty promises, peace, and security, in reality, it’s the yoking of humanity, We are on the Doorstep of the Great Tribulations.

Our elected officials, bureaucrats so-called law enforcement agencies are turning the people against each other, it’s demonic, The history of bureaucrats setting on the people, Nixon, Clinton, Bush, and of course Obama, the finale, Donald Trump, On November 8, 2016, I cast my vote for Donald Trump for President of the United States. I wanted “The Great Disruptor.” I wanted the swamp drained. But, above all, I wanted America to truly become great again. It didn’t happen, none of it. Instead, we’re in a far worse far more dangerous spot than we were just two years ago.

One where the Welfare State and the Warfare State threaten to destroy our economy, leaving ordinary Americans crippled in the wreckage. One where our national debt is approaching an astounding $23 trillion with no end in sight. One where border wars, trade wars, and Twitter wars have stolen our focus from a ticking time bomb, Americans freedom. One where the Deep State has boldly emerged from out of the shadows to steal our democracy right from under us, the elitist have taken over and the New World Order emergence. Americans fear their police force, the elected officials, and it’s obvious our justice system has no justice, Demons Knights have hijacked our churches, and the vast empire is in a state of despair. SRH…

Last Friday, to bipartisan cheers – and one sole, rational dissenter who was promptly silenced after asking “if $6 trillion is fine, why not $350 trillion” – Trump signed into law a $2.2 trillion corporate, hedge fund and bank bailout fiscal spending package, which quickly became the main topic of the current new cycle. What was not at all discussed, purposefully so due to the complexity of the underlying math, is that in parallel to the Treasury’s 2 trillion package, the Fed received a green light to lend up to $4.5 trillion in new credit (which is where Kudlow’s misconstrued “$6 trillion stimulus” comment came from).

And as usually happens with matters Fed related, the fact that the Fed received permission from the Treasury to “stimulate” by more than twice the full amount of the CARES act, flew right over America’s head. Which, if to be expected, is lamentable, because by giving the Fed a green light to inject money at will, the US government officially launched helicopter money.

Or rather, “helicopter credit” as Wrightson ICAP chief economist Lou Crandall put it, and as Bloomberg further refined it, “a Multitrillion Dollar Helicopter Credit Drop.”

So how do we get to $4.5 trillion? Here’s how it happened.

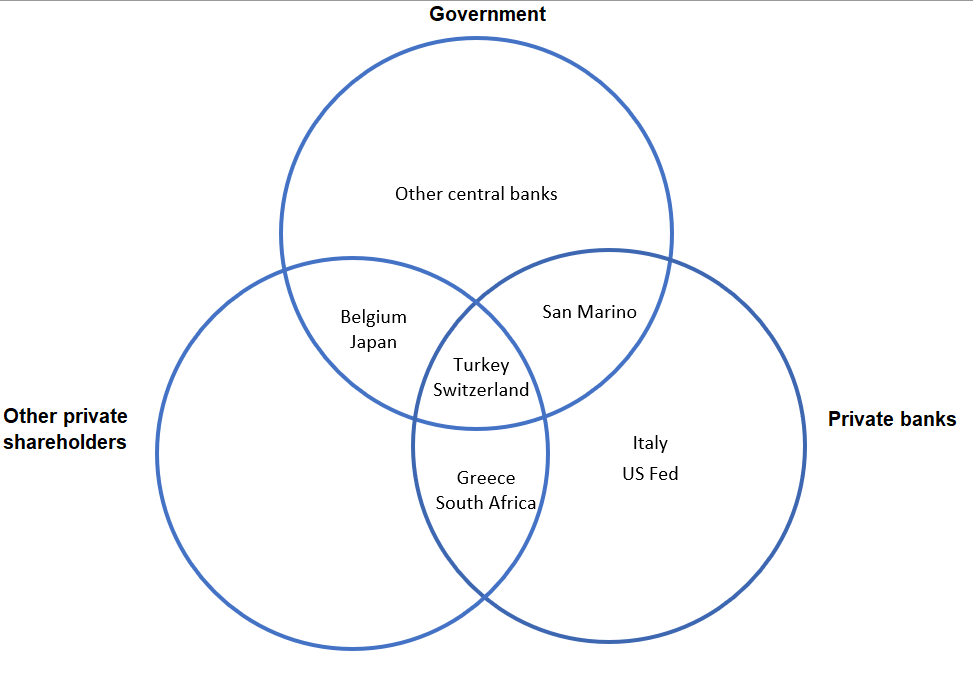

The roles of the Treasury Department and Federal Reserve are different in a bailout. The Treasury Department is part of the Executive Branch. It receives its funding from taxpayers. It is accountable to Congress and to the President. It just received $454 billion in the CARES Act. The Federal Reserve, in contrast, is a private, bank-owned agency that pretends to operate on behalf of the people but in reality, makes sure the financial system and the commercial banks that dominate are viable and profitable (if they aren’t they are bailed out).

As a result, the Fed’s members and private owners are banking institutions that keep massive reserves on deposit at the Fed. The Federal Reserve has many roles in the economy, but none of them is to take on credit risk. So how do you get the Fed to establish a “loan” facility, as contemplated in the CARES Act if it will not take on credit risk? And not just any loan but $4.5 trillion in loans?

This tsunami of credit (the helicopter comes next… and last) is made possible by the $454 billion set aside in the aid package for Treasury to backstop lending by the Fed. The Treasury’s contribution, as Tom Barrack explained recently, you can think of as “equity” — that is, Treasury will stand in a “first loss” position on every loan made to corporate America.

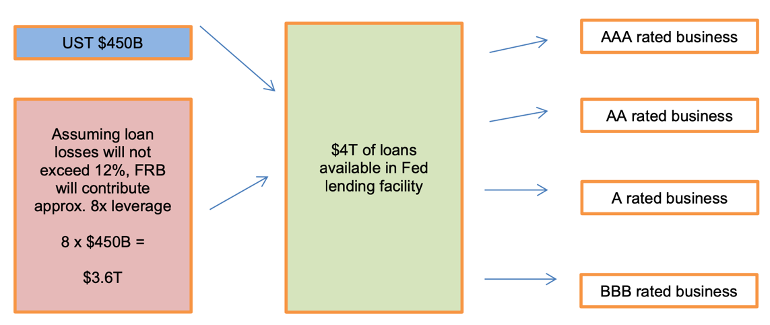

The Fed will contribute the “leverage” — the money that will help make loans using the Treasury’s equity and be levered 10-to-1. Such leverage assumes no more than 10% capital losses (on “AAA-rated” paper), as the Fed is not allowed to be impaired. Of course, in a real crash, the losses will be far greater but we’ll cross that particular bailout of the bailout when we get to it. The loan fund, now levered up ten-fold thanks to the Fed’s own $4.1 trillion, will then make loans to businesses.

“Effectively one dollar of loss absorption of backstop from Treasury is enough to support $10 worth of loans.” Fed Chair Powell said in a rare nationally-televised interview last Thursday morning. “When it comes to this lending we’re not going to run out of ammunition” and he is right – the Fed can apply any leverage it wants; after all the value of the collateral it lends against is whatever the Fed decides!

Visually, the magic of the Fed’s 10x leverage looks as follows:

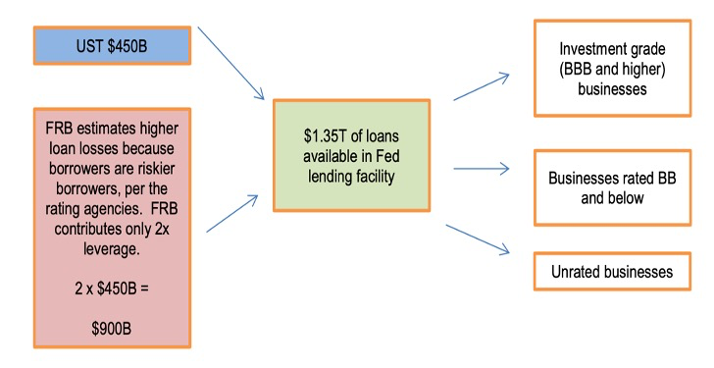

The overall size of the Fed-Treasury loan fund depends on how much Fed money will be supplied for every dollar of “equity” the Treasury contributes.

In theory, the answer is a function of what is called the “credit box.” If the loan program makes loans only to investment-grade companies (those rated BBB or higher), the Fed will contribute more capital than if the loan program makes loans to companies with lower credit ratings or no ratings at all. In other existing Fed loan programs, the Fed supplies about $9 for every $1 of Treasury capital, but in those programs, the loans are secured by extremely high-quality collateral (often AAA).

In practice, the Fed – which can “print” an infinite amount of dollars in exchange for any “collateral” including baseball cards, donkey turds, used condoms or oxygen – can lever up 20x, 50x, even 100x or more with zero regards for the underlying collateral.

And the real kicker is that what and how the Fed decides on what leverage to apply, how to value the collateral, and which companies to bailout (and which to let fail), is now a secret. That’s because the Senate-approved stimulus bill repeals the sunshine law for the Fed’s meetings until the President says the coronavirus threat is over or the end of the year (spoiler alert: the coronavirus threat will never be over). That could make any FOIA lawsuits to disclose details of what’s is taking place in Fed meeting a non-starter since it has been codified in federal law, to wit:

SEC. 4009. TEMPORARY GOVERNMENT IN THE SUNSHINE ACT RELIEF. (a) IN GENERAL.—Except as provided in subsection 8 (b), notwithstanding any other provision of law, if the Chairman of the Board of Governors of the Federal Reserve System determines, in writing, that unusual and exigent circumstances exist, the Board may conduct meetings without regard to the requirements of section 552b of title 5, United States Code, during the period beginning on the date of enactment of this Act and ending on the earlier of— (1) the date on which the national emergency concerning the novel coronavirus disease (COVID–19) outbreak declared by the President on March 13, 2020 under the National Emergencies Act (50 20 U.S.C. 1601 et seq.) terminates; or (2) December 31, 2020.

So what does all this mean? Three things:

- the US population will go in debt to the tune of at least $454 to pre-fund the Treasury’s “first-loss” equity tranche which will be then handed over to the Fed as seed capital. That’s in addition to the trillions in additional debt the Treasury will incur to fund the fiscal stimulus and whatever subsequent programs it launches.

- the Fed will then apply 10x – or much more – leverage to make any collateral it makes loans against “money good”, bailing out any and all asset holders while triggering the endgame of the US dollar as the world’s reserve currency because, without even a veiled pretense of scarcity, the dollar literally becomes less valuable than toilet paper.

- As JPM’s chief economist Michael Feroli put it, “The Fed has effectively shifted from lender of last resort for banks to a commercial banker of last resort for the broader economy.”

And the punchline: this mechanism which is now codified by law and which grants the Fed literally unlimited power to bail out anything and anyone, and which marks the beginning of the end for the US dollar, was delivered by America’s politicians with pride:

“Very quickly we hope to stand up a very broad-based lending facility that could be leveraged up to $2 or $3 trillion,” Senator Pat Toomey told reporters Wednesday. “We’re hoping it’s a mechanism to keep businesses alive for a few weeks or months until our economy can resume.”

And if it can’t resume in a “few weeks or months”, the mechanism will keep running until the Fed can – and will – nationalize everything.

So congratulations America, you were just bought by a group of anonymous bankers with your own elected politicians making it possible. The price? $1,200 per person per month for a month or two…

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The 127 Faith Foundation understands the pain and sorrow associated with being a throwaway child, We push this throwaway child towards bettering their education, be it junior-college are going for a Masters’s degree. This program is about them because they determine by the grace of God if they’re going to be a pillar in the community or a burden on society. Some of the strongholds orphans deal with are: fear, resentment, bitterness, unforgiveness, apathy, unbelief, depression, anxiety, lust, anger, pride, and greed. Many of these strongholds do open the door to addiction. Please Help The 127

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Fraud, Banks, Money, Corruption, Bankers, Powerful Politicians, Businessmen, Bitcoin, CoronaVirus, GOLD, Fraud

![]()